SARS correspondence delivery

The integration of Konsise with SARS eFiling has facilitated data exchange through both push and pull mechanisms. SARS eFiling, while a popular platform for tax-related matters, has been criticised for its lack of collaborative features, impeding efficient tax correspondence handling and responses. In certain cases, tax-related communication may not be easily accessible to all members of a tax team. The integration provided by Konsise mitigates this issue by facilitating the pull and display of SARS correspondence for all tax types integrated with the platform.

Never miss SARS correspondence again

We understand that the correspondence received from the South African Revenue Service (SARS) via eFiling can sometimes be slow and unreliable, causing potential issues for your business. But worry not, as we offer a highly reliable and efficient integrated system for SARS correspondence that ensures timely receipt and distribution of all SARS notifications related to integrated tax types to your entire team. With our system in place, you can be confident that no important SARS correspondence will be missed, and your team will always stay informed and alert. Our integrated correspondence system is designed to mitigate the impact of SARS eFiling’s occasional sluggishness and unreliability, ensuring that your business operations remain optimal. So, why take chances with SARS eFiling when you can have our proven, efficient system in place?

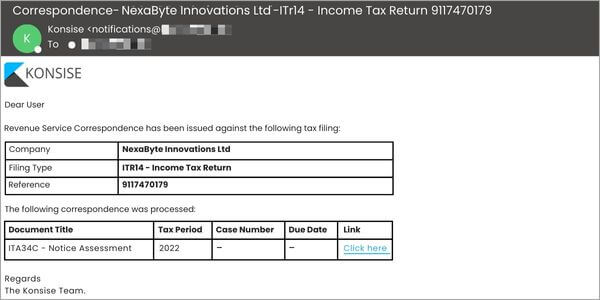

Real-time SARS notifications via email

Each instance of SARS correspondence triggers real-time email notifications through Konsise, enabling swift access via a direct link to the document on our platform. This streamlined process enhances accessibility, facilitating improved team collaboration by extending notifications to all preparers and reviewers associated with a specific tax filing.

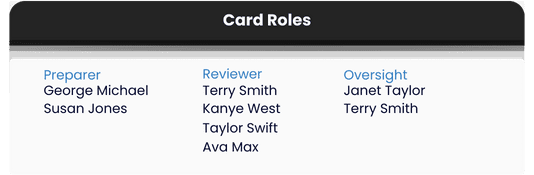

Team access to SARS correspondence

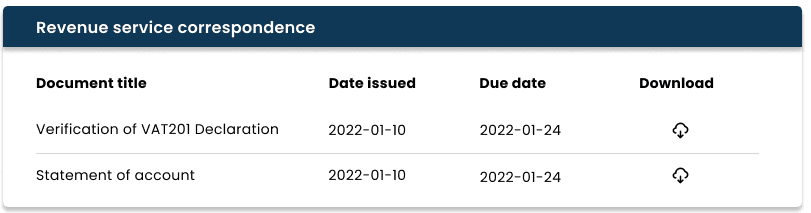

All correspondence related to SARS is automatically associated with the pertinent tax filing, granting your team full access to it. The dates of correspondence, alongside the option to download it, are also visible. The Konsise tax software, in particular, empowers entire tax teams by providing them with access to all SARS correspondence related to integrated tax types. With SARS issuing correspondences and statements of accounts through eFiling, our software seamlessly retrieves this information, ensuring that it reaches your team promptly via email.

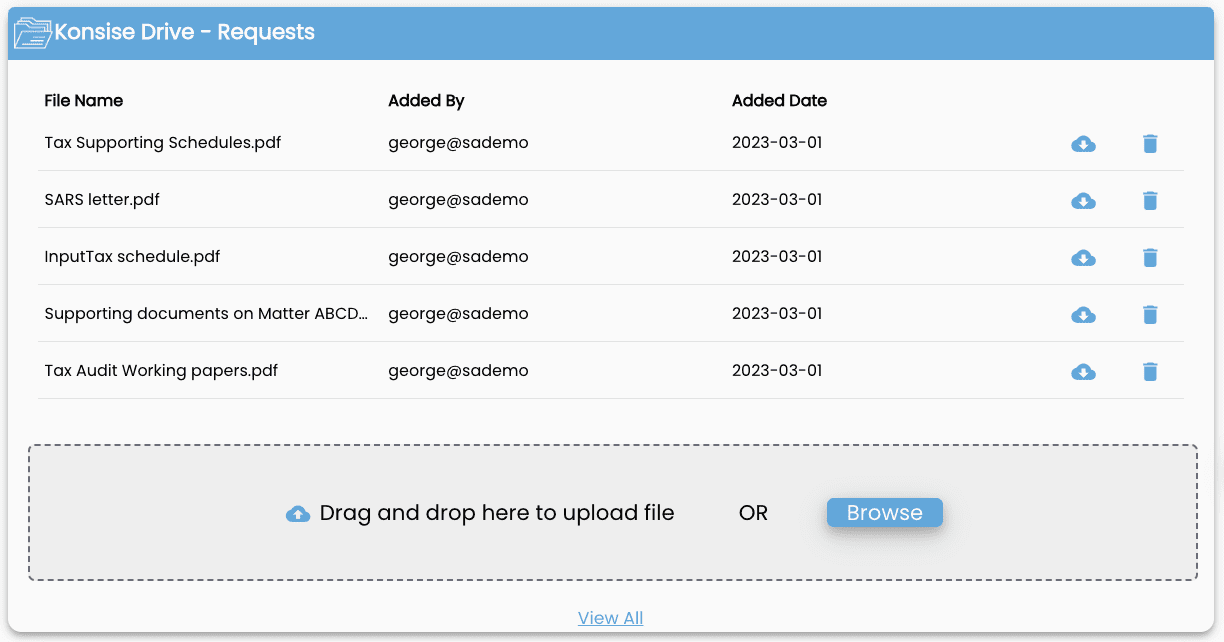

Automated storage of SARS correspondence

All SARS-related correspondence is appended to the corresponding tax return and is then dispatched with a notification to ensure that it is brought to your attention. In addition, we deposit it into your Konsise inbox, which is easily filterable by date or time period.

Easy access to SARS correspondence

Our comprehensive system guarantees that all types of correspondence, such as statements of account, VAT verifications, assessments, general letters, and corporate tax verifications, are meticulously recorded and filed together with tax returns. Besides, we alert our clients with notifications to prevent any oversight, ensuring that all crucial documents are accounted for and readily accessible within our Konsise platform. Our system provides an efficient and reliable way for businesses to manage their tax-related paperwork, reducing the risk of errors and increasing compliance with regulatory requirements

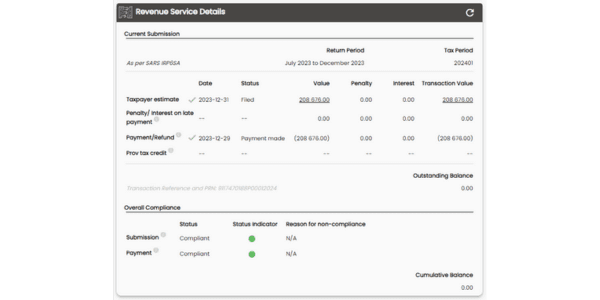

Effortlessly monitor Statement of Account

Integrating the Statement of Account (SOA) with SARS provides a convenient way to access all the relevant information on the SoA, including the value of submissions and payments. This eliminates the need for manual login into the eFiling system to check for the accuracy of submissions. The tool enables easy management of the current statement value, saving valuable time for individuals and teams in the tax workflow.