Introduction

The purpose of this guide is to explain what the process is for a company to registering to become a Value Added Tax (VAT) vendor in South Africa as well as explaining the purpose of VAT.

As revenue collection agencies across the globe continue to invest in technology to improve tax compliance and increase tax collection, it has become extremely important for the South African Revenue Service (SARS) to modernise and simplify the tax process to better their service standards and increase the efficiency around risk assessment and tax compliance.

With the evolving tax environment and SARS R3 billion technology and infrastructure upgrade in mind, it has become important for companies to invest in the correct tools and software platforms to keep their companies tax process as reliable and compliant as possible. There are numerous tools, affectionately referred to as electronic tax management software, that can help with digitalising company tax processes. These tax management tools are designed to streamline the process and help you prepare and organise VAT 201 declarations and help with determination of the submission values.

We recently published a blog on the best way to find the right tax management software for your business.

Please Note: The words “declaration” and “return” are used interchangeably in the document but both refer to the VAT201 Declaration.

What is VAT201?

The South African Value Added Tax return is known as the VAT201 return, but it is sometimes also referred to as the VAT201 declaration. This is a specific tax return payable by companies or businesses who operate in the Republic of South Africa. VAT is an indirect tax which is charged based on the consumption of goods and services within the economy and effective 1 April 2018 is levied at a standard rate of 15% to registered VAT vendors.

Is my company liable to register to pay VAT?

A company rendering goods and services in the country of South Africa must registered to pay VAT if the total value of taxable goods or services is more, or projected to be more, than R1 million in a 12-month period. However, any company may voluntarily register themselves as a VAT vendor if their income in the past 12 months has exceeded R50 000.

The compulsory registration threshold for foreign electronic services suppliers was increased from R50 000 to R1 million effective from 1 April 2019.

If at any point a company wants to cancel their VAT registration, it can only be done under certain circumstances.

- The company has ceased to operate in South Africa, or

- The total value of taxable goods or services no longer exceeds R1 million in a 12-month period.

What are the benefits of registering for VAT and becoming a VAT vendor?

Voluntarily registering for VAT is a big decision for small businesses. However, there may some advantages that will make this decision easier. Some of the advantages of registering for VAT in South Africa include:

- Business credibility. Often small businesses will try to build repour to persuade potential clients of its reliability and dependability. One of the ways to build this reliability is showing that you have enough clients to have a higher turnover as a turnover of R50 000 or R1 million rand over a 12-month period. The difference between these two distinctions is voluntarily registering or compulsory registration respectively. These two circumstances whichever may be the case, are unbeknownst to clients or competitors and therefore may automatically create a feeling of reliability and trustworthiness.

- Cash flow for capital-intensive business structures. If a company requires large amounts of capital outlay for business requirements such as heavy machinery, a R10 000 purchase will cost you an extra R1 500 in VAT, an amount that will only be able to be claimed back from SARS if the company is VAT registered. Not being VAT registered in this situation could place unnecessary strain on cash flow and business operations.

What are the disadvantages of registering to pay VAT and becoming a VAT vendor?

As a small business these are some of the reasons why it wouldn’t make sense to voluntarily register as a VAT vendor in South Africa. Some reasons include:

- Business processes. VAT compliance is a big, and possibly cumbersome, responsibility once a business is VAT registered. There are various changes to processes and business operations that need to be updated immediately after becoming a VAT vendor. These compliance factors are constantly being updated by SARS and requires someone to be extremely diligent in keeping up with latest VAT laws as well as making sure these new regulations are carried out throughout the whole business. VAT determination requires a solid and effective business operation as VAT returns need to be submitted monthly or every two months, depending on the revenue threshold. This may become a costly and time intensive process.

- Record keeping. According to the Companies Act, all relevant documentation for VAT applicable transactions needs to be kept as evidence for up to 7 years. This impacts on record keeping and bookkeeping systems that may need to be upgraded to facilitate these new processes. Find out more about an easy way to keep your relevant tax files and records organised and secure.

- Cash flow. Once registered for VAT it is imperative to immediately start charging VAT on an invoice basis and keep track of all input as well as output tax. What this means is, if a large invoice is generated in a specific two-month period, it is critical to ensure that the VAT portion on the invoice is paid to SARS whether the payment of such invoice has been received or not. This can create extreme cash flow problems especially for small businesses. This problem may become even worse when dealing with debtors who do not pay you at all which may require writing off such debt, leaving you with an in-depth process of recovering VAT paid to SARS.

- Competitiveness. Once a company is registered for VAT it is compulsory to charge VAT on every invoice. Adding an additional 15% to the price of your goods or services, makes them more expensive. This could impact your ability to remain competitive, especially if the price increase is significant relative to others in the market. Furthermore, a higher price may be less appealing to smaller customers that aren’t registered for VAT and aren’t able to claim the input VAT back from SARS.

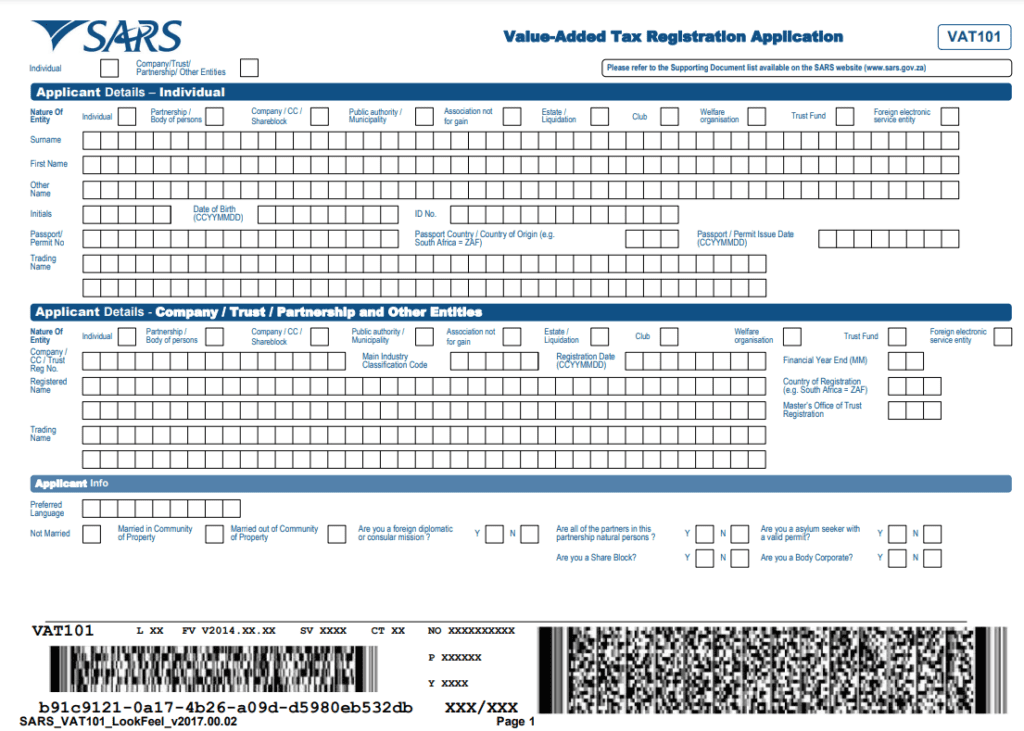

How do I register to pay VAT?

To register your company for VAT you must complete the VAT 101 – Application for Registration form and submit this form to the local SARS branch. If the registration for VAT is a compulsory registration due to the total value of taxable goods or services being more than R1 million over a consecutive period of 12 months, you are required to submit this form 21 days from the date of exceeding R1 million. There is also the option to register your company for VAT through the eFiling platform which is discussed further below.

How to register for VAT voluntarily?

The following information is adapted directly from https://www.sars.gov.za/ and the original article can be found here:

There are five categories of voluntary registrations that applies to specific types of persons, as follows:

- There is no voluntary threshold for the value of taxable supplies made by the person. This category includes for example the activities of a municipality or a “welfare organisation” as defined in the VAT Act.

- The value of taxable supplies made by the person exceeded the voluntary threshold of R50 000 in the past period of twelve months.

- The value of taxable supplies made by the person did not exceed the voluntary threshold of R50 000. The requirements and conditions to register under this category is listed in General Notice R.447, as published in Government Gazette No. 38836 dated 29 May 2015 (the Regulation).

Some of the requirements listed under the Regulation are, for example –

- In the case of a person who has made taxable supplies for only one month preceding the date of application for registration, such person must prove that the value of the taxable supplies made for that month exceeded R4 200;

- Where the person has not made taxable supplies, such person must have a written contract, in terms of which the person is required to make taxable supplies exceeding R50 000 in the 12 months following the date of registration;

- The person acquired the business as a going concern.

- The specific nature of activity carried on by the person is listed in General Notice R.447 as Published in Government Gazette No. 38836 dated 29 May 2015 (the Nature of Activity Regulation). Listed activities in the Nature of Activity Regulation include the following:

- Agriculture, Farming, Forestry and Fisheries

- Mining

- Ship and aircraft building

- Manufacture or assembly of plant, machinery, motor vehicles or locomotives

- Property development

- Infrastructure development

- Beneficiation

If you think your company qualifies to register for VAT voluntarily based on the information above you can complete the VAT 101 – Application for Registration form and submit it to a local SARS branch. Alternatively, you can register yourself on the SARS eFiling platform.

To find a local SARS branch you can use this SARS branch locator tool.

What is a VAT liability date and how does it work?

The date on which a vendor can charge VAT or claim input tax deductions is known as the VAT liability date. This date is established as part of the registration process and cannot be set more than three months into the future.

The SARS eFiling (RAV01) system permits backdating for compulsory VAT registrations only up to six months from the date when the R1 million threshold was exceeded.

Voluntary registrations cannot be backdated, and thus the VAT liability date will be established as the date of application. If a voluntary registration must be backdated, the vendor may do so in person at a SARS branch.

Any backdating must be performed at a SARS branch and requires the submission of all supporting documentation to justify the request for a backdated registration.

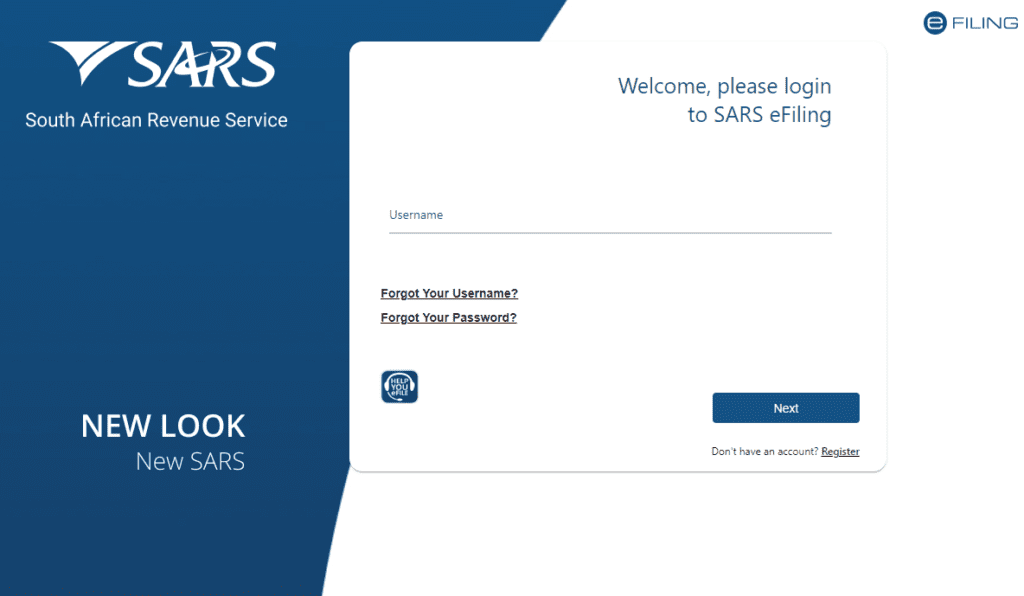

How to register for VAT through SARS eFiling?

The following process will be applicable to those who have already submitted the VAT 101 – Application for Registration form and you have received an allocation of a VAT reference number.

Step 1

- Navigate to https://secure.sarsefiling.co.za/app/login

- Log in with your username and password

Step 2

- Once logged into eFiling, select “Organisation Tax Types” from the side menu options under the Organisation tab.

Step 3

- Tick the “VAT201” box to register for VAT, and fill in your VAT Reference Number and the relevant Tax Office in which you initially completed the application process through, in the space provided.

Step 4

- The following messages will appear on the screen: “Tax Types successfully updated” and “Awaiting User Activation”

Step 5

- The information provided will go through a validation process and SARS will activate the user account and the status will be updated to “Return Successfully Activated”.

Read more on how to register for VAT

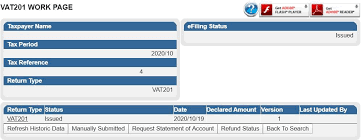

How to request a VAT201 Declaration?

This process will only be applicable to those have completed a successful VAT registration through SARS eFiling and their status is currently “Return Successfully Activated” as seen in the process above.

Step 1

- Select the “Value Added Tax (VAT201)” declaration under “Returns Issued” from the side menu.

- If you receive the following message “No records available for your selection”, select the period you are looking for by clicking on the “request Return” button near the top right hand corner.

Step 2

- You can view any issued declarations and may proceed to view specific declarations by clicking on “Open”

- You will now be presented with the following screen.

- You are now able to open the specific declaration in the ADOBE reader by selecting this option and clicking on the “VAT201” link.

Step 3

- The ADOBE reader will now display as a form with some pre-populated information including:

- Trading or Other Name

- VAT Registration Number

- Tax period for which the declaration is to be made

- Payment Reference Number (PRN )

- Diesel Rates to be applied for the applicable year in which the indicated tax period falls and according to the type of diesel rebate for which the vendor is registered.

How do I cancel my VAT registration?

Reasons to cancel VAT registration

The most common reason for cancellation of a VAT registration is when a company has no longer exceeded the compulsory threshold of R1 million in any consecutive period of 12 months. There are also certain circumstances which may result in a company having to deregister for VAT but requires specific approval from the Commissioner.

Circumstances to cancel VAT registration include:

- the vendor is no longer in business and will not start up again within the next 12 months;

- the business never actually commenced or will not commence within the next 12 months;

- the requirements for voluntary registration are no longer valid;

- the vendor has failed to furnish a return that is required for purposes of calculating the tax, or

- the vendor was registered under the voluntary registration category and –

- has not fixed place of abode or business;

- does not keep proper accounting records;

- has not opened a bank account in respect of the enterprise; or

- was previously registered under the VAT Act or Sales Tax Act and failed to perform any duty imposed under those Acts.

There may be cases where the main vendor has other enterprises/divisions/branches that may also need to be deregistered for VAT. These may be cancelled if:

- the vendor applies in writing;

- the main registration is cancelled (in which case, all of the branch registrations will be cancelled); or

- it appears to the Commissioner that the duties under the VAT Act or the TA Act have not been carried out properly.

The cancellation is effective on the last day of the tax period in which he or she ceased all business operations. However, the Commissioner may determine another date as the effective date. In the event of the cancellation of a branch registration, all duties revert to the main registration. In cases where the VAT registration for the main registration is cancelled, the VAT registrations for the branches are also cancelled.

Please note: You request for cancellation will not be finalised until all obligations and liabilities owed to SARS have been settled.

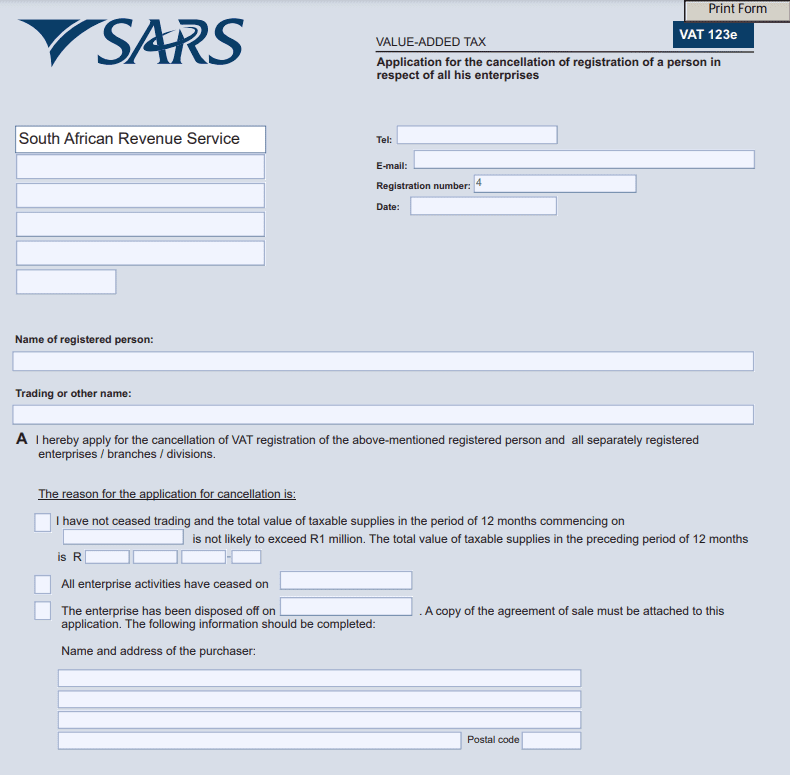

What is the process of cancelling a VAT registration?

The first step for cancelling a VAT registration is to fill out the VAT 123e – Application for the cancellation of registration of a person in respect of all his enterprises form. This can only be submitted with an appointment with the SARS branch in with your enterprise is registered. If you would like to cancel registration for a separate registered enterprise you must fill out the VAT123T form.

Once the form has been submitted you will wait for a letter of acknowledgement from the Commissioner which will inform you of the date of which cancellation will take affect as well as the enterprises final tax period. This letter of acknowledgement may also contain instructions and next steps for the cancellation process.

Please note the following:

- Any late payment of VAT during this process will accrue a penalty and interest on outstanding amounts.

- During your cancellation application period, the enterprise is still required to charge VAT of any goods or services offered.

- You will have to account for output tax and deduct any input tax up to the last day as stated in your letter of acknowledgement.

Find out more about cancelling your VAT registration.

Related Documents to VAT cancellations

VAT123D – Application for the Cancellation of Diesel Registration of a Person – External Form

VAT123e – Application for Cancellation Registration iro Enterprises – External Form

VAT123T – Application for Cancellation of a Separately Registered Enterprise – External Form