Konsise Resources

Konsise recent blog articles

Tax practitioners: vital for tax system integrity. But, communication gaps hinder compliance efforts, risking system functionality and revenue collection.

Marius Bothma’s appointment as Tax Technology Lead signals a strategic move to redefine the landscape of tax software in the country.

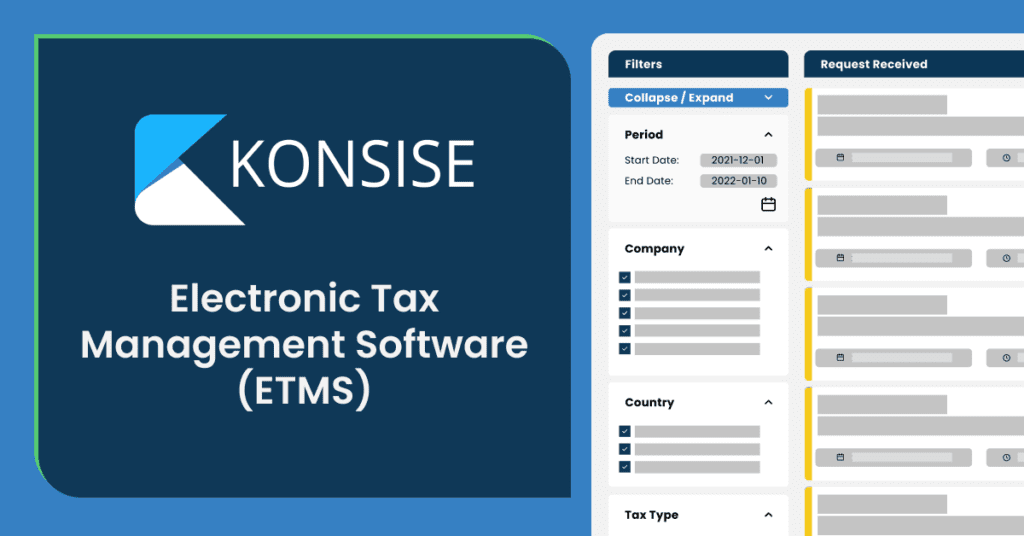

Explore the 7 key signs of tax management digitalisation in South Africa. Konsise is your partner in the digital evolution of tax compliance.

eBooks

Discover 9 things that could be WRONG with your VAT data and submissions.

Spend less time managing low-value repetitive tasks

Use Konsise to streamline your regulatory teams, processes and data together in one place.

*Terms and conditions apply