Tax Oversight Dashboard

Effortless tax management for oversight of multiple companies, trusts and individuals.

To effectively oversee a company’s taxes, being a subject matter expert is unnecessary. However, understanding the group structure is crucial for a holistic view of the overall tax health. This can help turn tax processes into a strategic asset that adds value to the company’s financial success. Tax obligations come with strict deadlines, payments, audits, and verifications that are often cumbersome. However, implementing effective tax oversight practices can simplify financial governance, enhance financial oversight, and reduce exposure to legal risks and penalties. Konsise provides clear insights into the overall tax health of all the legal entities you oversee. It offers clear visibility into the submission and payment status for various tax types and progress updates on audits or verifications, all within a streamlined system.

Built-in enterprise-grade security

World-leading security and compliance are built in, ensuring your company’s sensitive tax data remains protected.

Features for tax oversight

Transparent insights with no manual entry

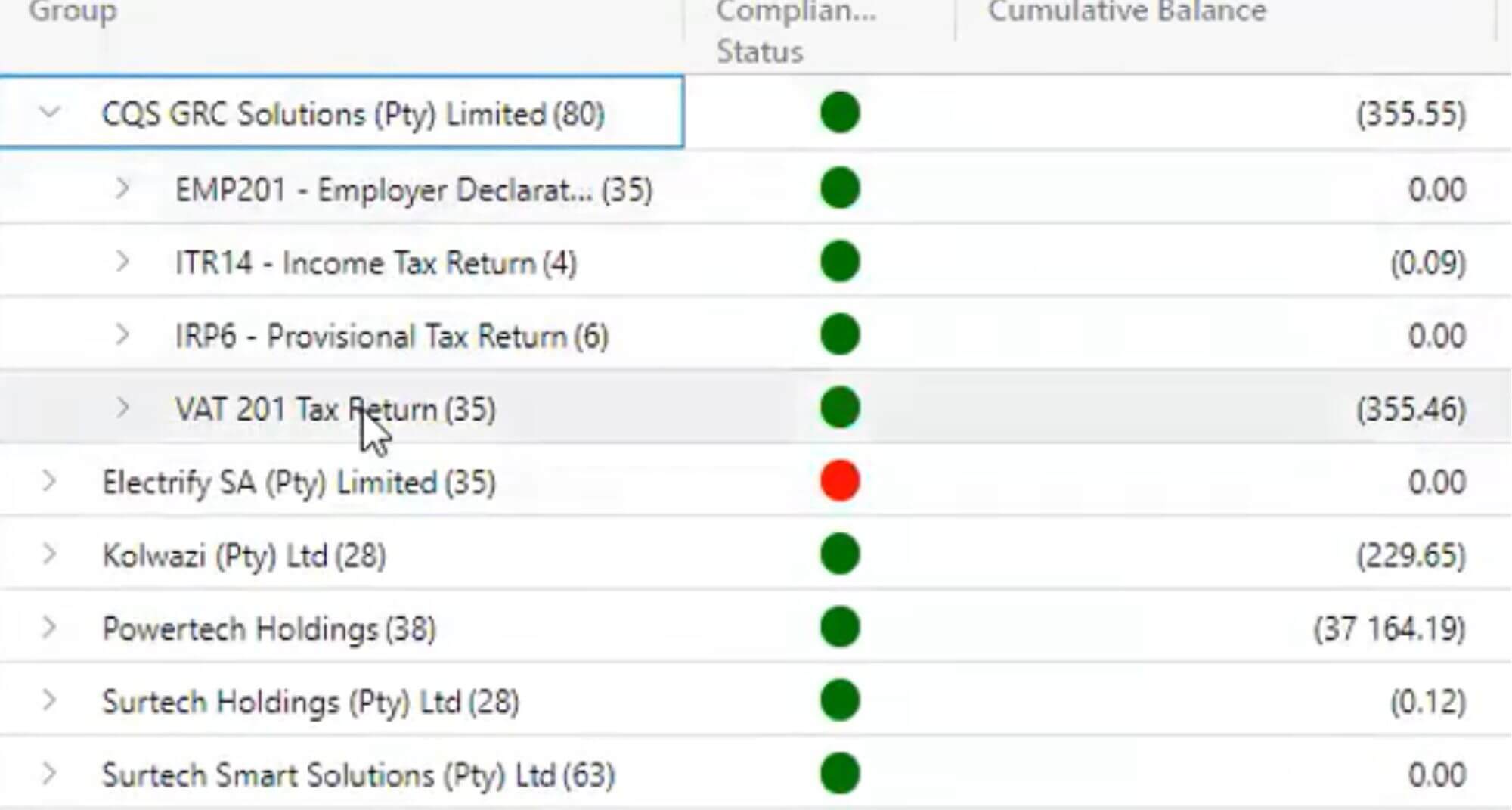

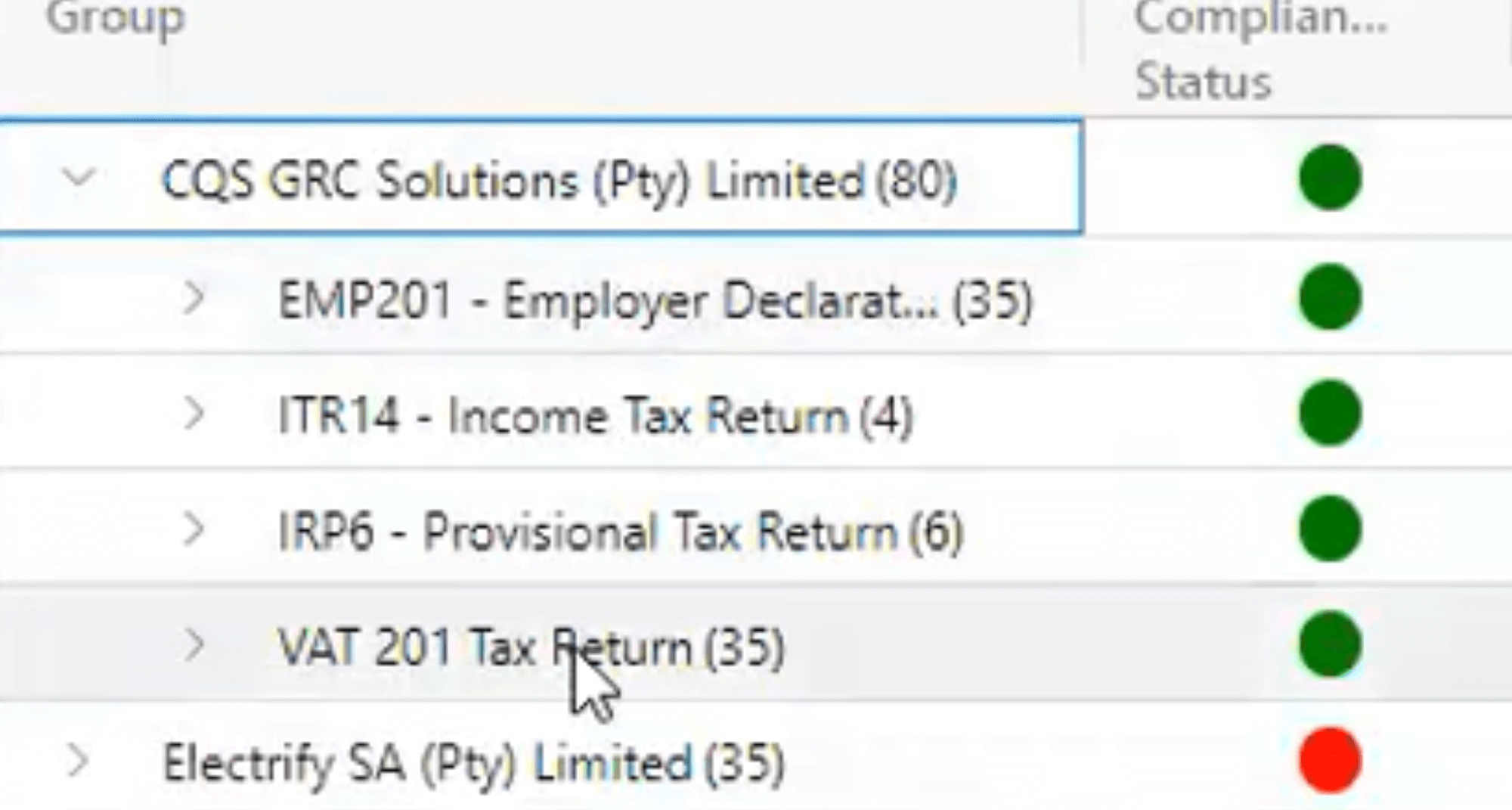

Comprehensive compliance reports are available for companies, individuals, and trusts, presenting cumulative balances categorised by tax types, including VAT201, ITR14 Income Tax return, EMP 201 Employer declaration, and IRO6 provisional tax returns. This provides a detailed and organised overview of financial obligations, enhancing transparency and facilitating efficient compliance.

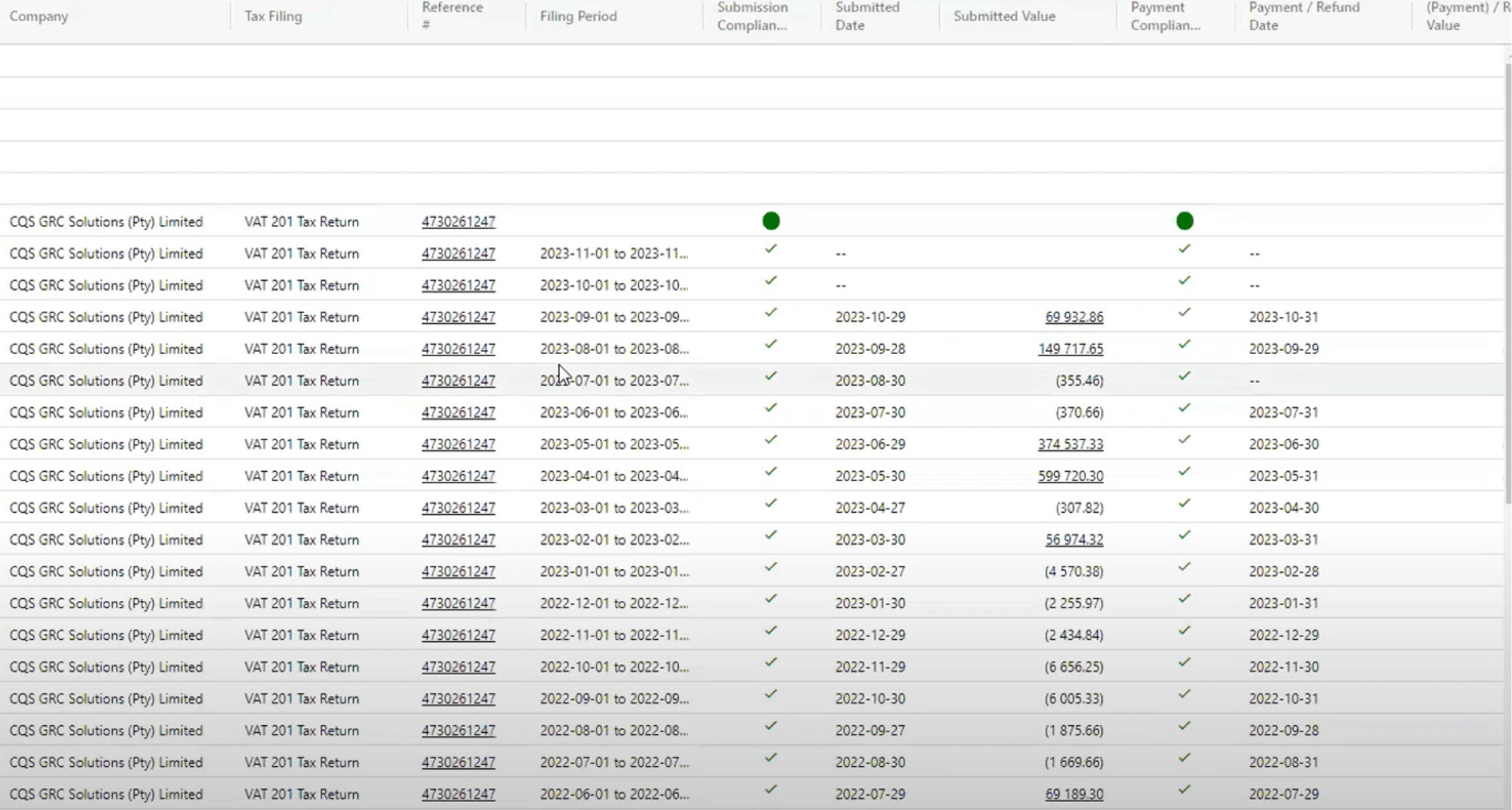

Access historical tax returns

Access a comprehensive overview of historical tax information at a glance, including submission dates, submitted amounts, payment details, and dates, eliminating the need to check historical files manually and enhancing the ease and convenience of managing historical tax periods.

Accurate tax compliance data

The accuracy and reliability of reporting are maintained through seamless integration with SARS. Eliminating the need for manual data entry assures a meticulous and reliable reporting experience.

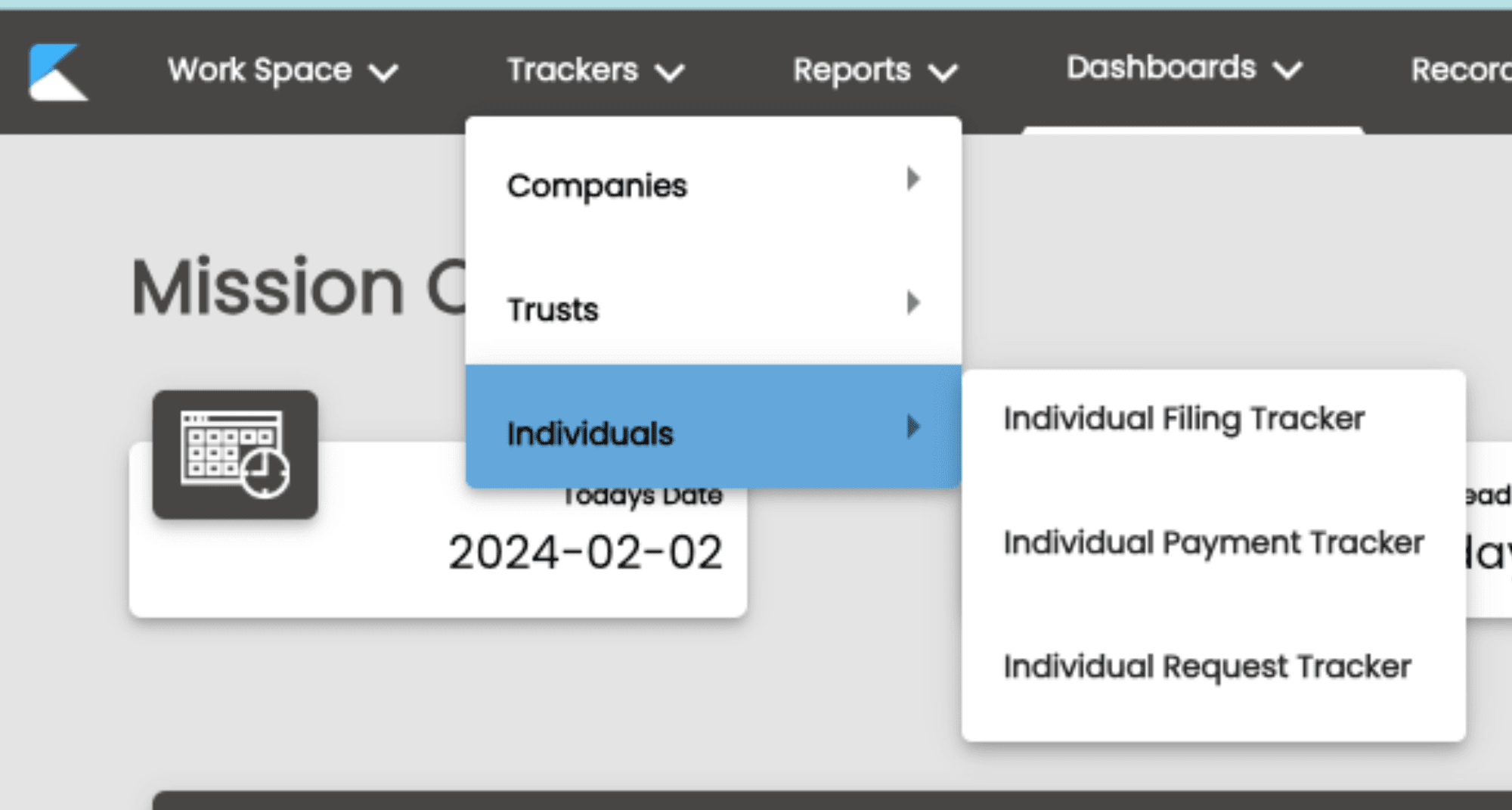

Compliance checking for different entity types

Our system is specifically designed to cater to the unique needs of various entity types, be it companies, individuals, or trusts. This customised approach allows for a more accurate assessment of the compliance status of each entity, ensuring strict adherence to specific regulations and guidelines applicable to their respective classifications. With our tailored approach, you can rest assured that your compliance needs are being met with utmost precision.

Spend less time managing low-value repetitive tasks

Use Konsise to streamline your regulatory teams, processes and data together in one place.

*Terms and conditions apply