Company Tax Compliance Software for SARS Obligations

Streamline multi-entity compliance processes and stay ahead of SARS regulations & requirements.

Only a purpose-built tax tool can leverage automation to its fullest to help and keep your company tax compliant with SARS.

Regardless of your company’s industry, you need software that keeps up with the latest regulatory changes and complexities to help you stay compliant with SARS while saving you time. Streamline your compliance burden with enterprise-grade security, powerful workflows and real-time reporting capabilities.

Built-in enterprise-grade security

World-leading security and compliance are built in, ensuring your company’s sensitive tax data remains protected.

Transform the way your teams work

Our all-in-one platform enables finance, tax and revenue authorities to achieve and maintain compliance goals collaboratively.

Company Tax Compliance

For companies looking for simpler, faster & easier tax management and SARS compliance.

Use cases:

- Automated tracking, reminders, and submission workflows

- Document storage, tax reporting, and tax audit workflows

- Integrated SARS submissions and retrieval of correspondence

- Preparation, review, and sign-off workflows that enhance financial oversight.

- Better tax insights

Secretarial Entity Management

Lighten the manual burden of company secretarial tasks required by CIPC to support regulatory compliance.

Use cases:

- Easy management of share registers

- Streamline trustee and beneficial ownership declarations

- Centralised & secure documentation storage

Konsise Features for Companies

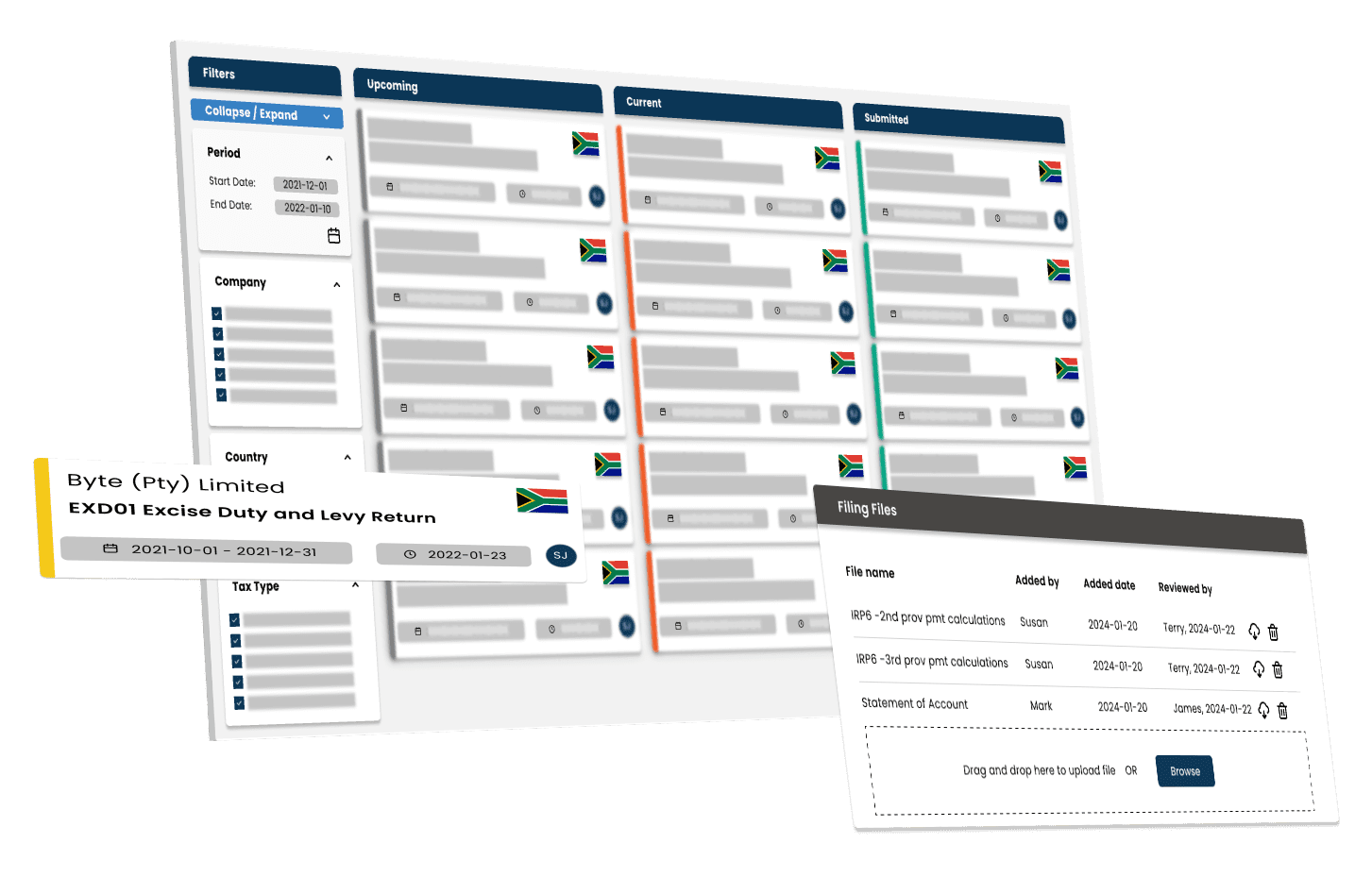

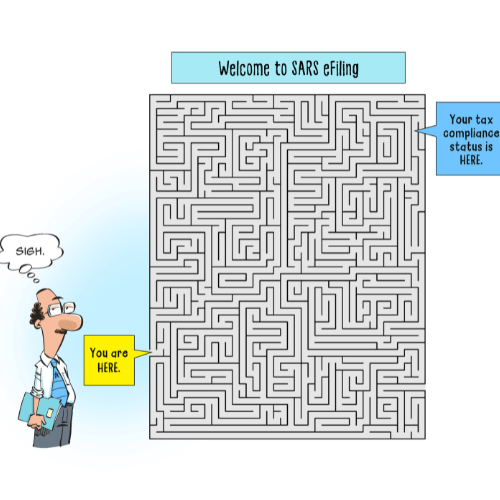

SARS Correspondence

The integration of Konsise with SARS eFiling has facilitated data exchange through both push and pull mechanisms. SARS eFiling, while a popular platform for tax-related matters, has been criticised for its lack of collaborative features, impeding efficient tax correspondence handling and responses. In certain cases, tax-related communication may not be easily accessible to all members of a tax team. The integration provided by Konsise mitigates this issue by facilitating the pull and display of SARS correspondence for all tax types integrated with the platform.

Tax record keeping

Maintaining a coherent and secure record-keeping system is pivotal. Traditional methods, whether they involve manual filing of hard copies or digital storage on platforms like SharePoint or File Explorer, often fall short. These systems lack contextualisation, making access cumbersome and time-consuming. Moreover, they pose significant security risks and the potential for lost or misplaced files.

Tax preparation, review and sign-off

A single individual often assumes the tax preparation task, which poses various challenges, such as lack of oversight and the inherent risks in self-checking. Adopting a robust and secure approach to tax preparation, review, and sign-off is imperative. Konsise offers a comprehensive solution advocating the best practice of segregating duties by delegating distinct roles to various team members in the tax preparation process and streamlining the tax workflow by assigning responsibilities for preparation, review, and final sign-off to various team members. This ensures a thorough and meticulous examination of tax documents, reducing the likelihood of errors and enhancing the overall accuracy of tax filings. By leveraging Konsise, companies and accounting firms can facilitate collaboration and adhere to industry best practices in tax compliance. With Konsise, you can elevate your tax preparation standards, ensuring efficiency and increased security.

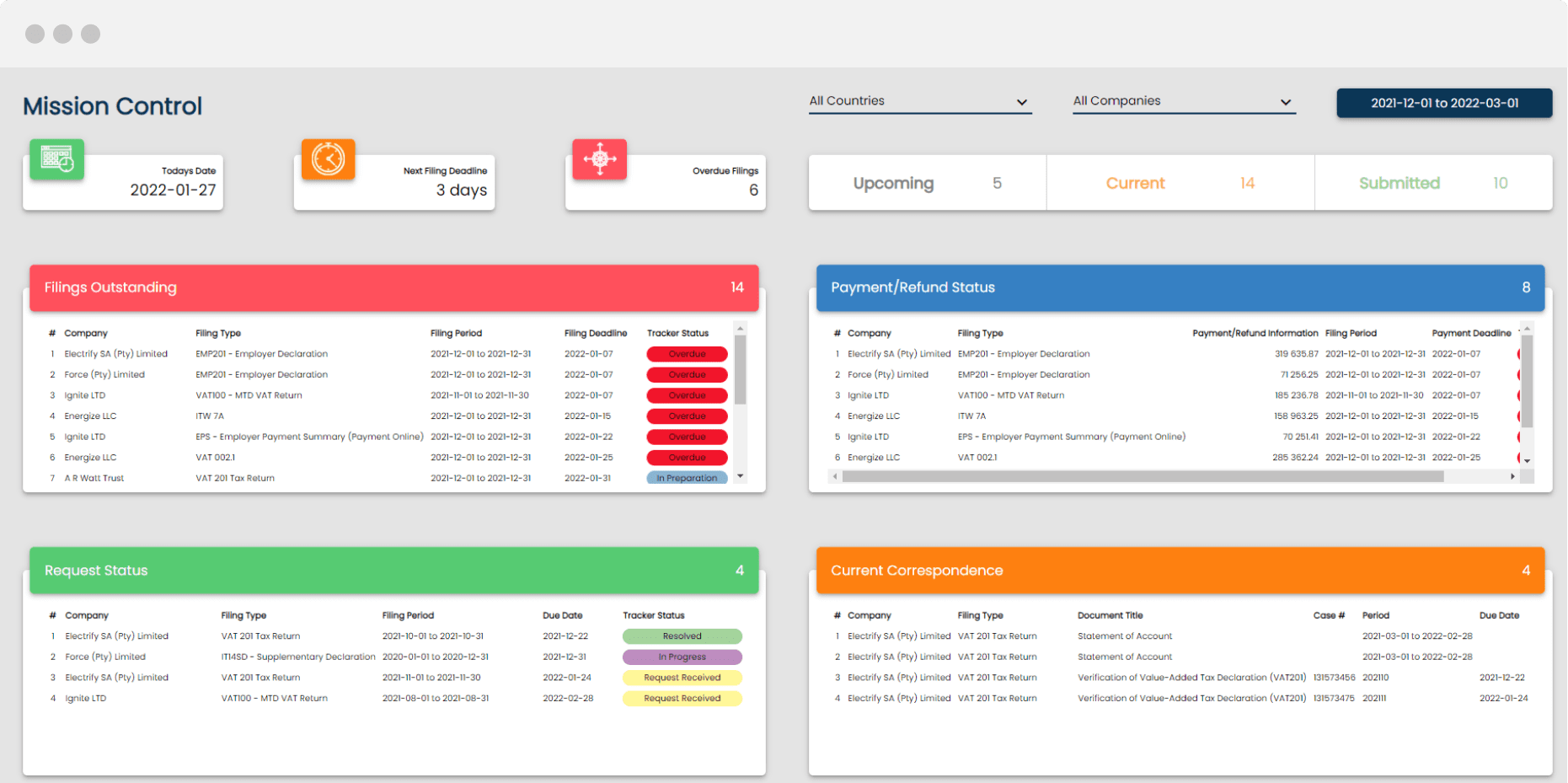

SARS submission & payment monitoring

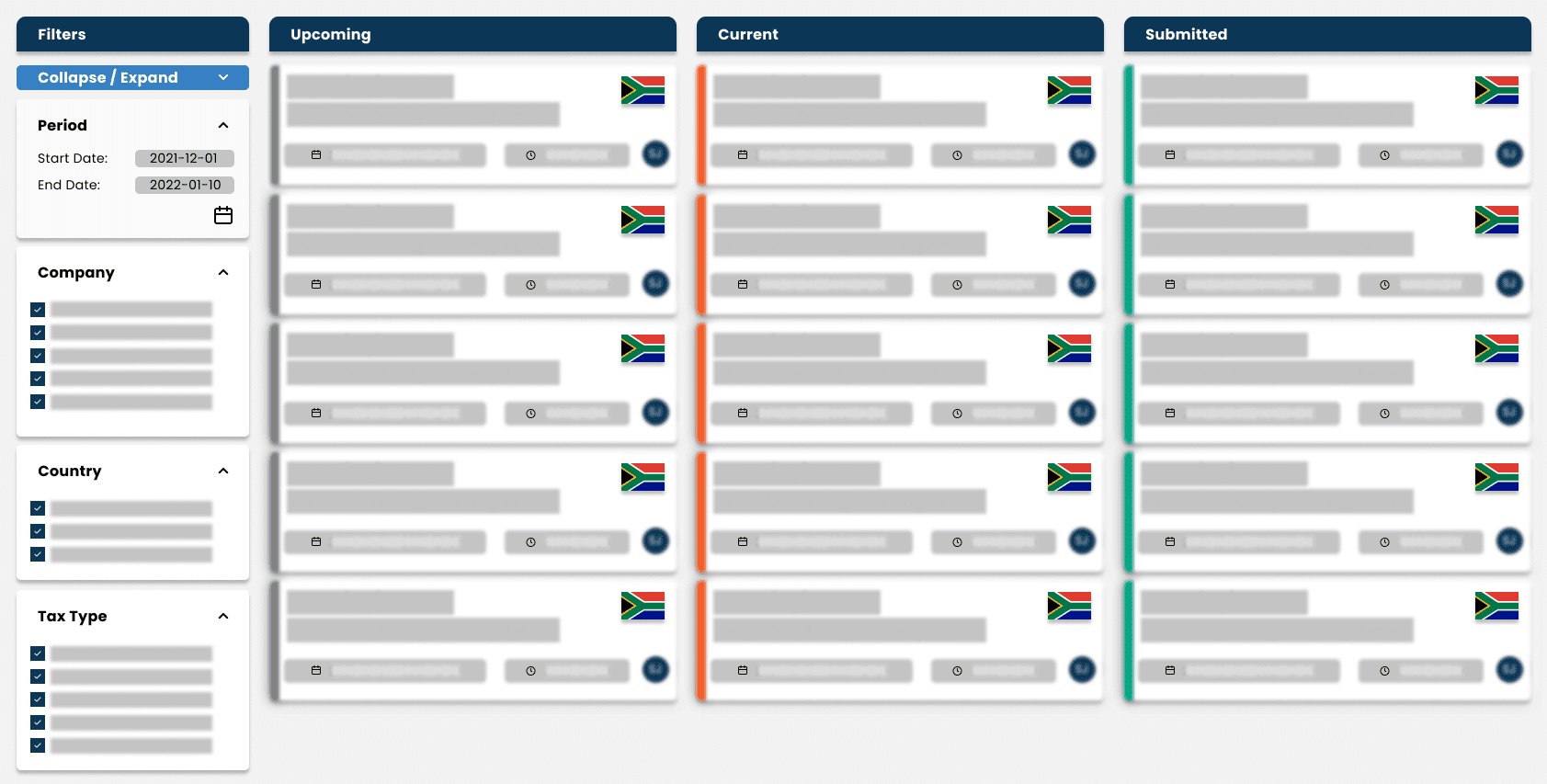

Instantly review tax compliance status and resolve non-compliance issues promptly. Say farewell to laborious, error-prone manual tracking through endless SARS eFiling logins and spreadsheet with a dashboard summary, featuring simple green or red indicators for all legal entities. This streamlined approach revolutionises tax compliance management, to save users valuable hours each month.

Tax compliance checking

Manual tax compliance tracking is laborious and error-prone, requiring endless logins into SARS eFiling and manually managing this in a spreadsheet. Konsise is an efficient tool that provides a dashboard summary of tax compliance for all legal entities within a group company structure or clients of an accounting firm. Featuring simple to understand green and red indicators, this tool revolutionises the process. Say goodbye to the time-consuming task of logging into SARS eFiling for each check. Now, this essential activity is completed faster and more straightforward, ensuring a streamlined and reliable approach to tax management. Upgrade to effortless tax compliance with our innovative solution.

Tax oversight

To effectively oversee a company’s taxes, being a subject matter expert is unnecessary. However, understanding the group structure is crucial for a holistic view of the overall tax health. This can help turn tax processes into a strategic asset that adds value to the company’s financial success. Tax obligations come with strict deadlines, payments, audits, and verifications that are often cumbersome. However, implementing effective tax oversight practices can simplify financial governance, enhance financial oversight, and reduce exposure to legal risks and penalties. Konsise provides clear insights into the overall tax health of all the legal entities you oversee. It offers clear visibility into the submission and payment status for various tax types and progress updates on audits or verifications, all within a streamlined system

SARS Statement of Account archive

Konsise provides users with a complete archive of all Statements of Account from SARS. This is more comprehensive than SARS eFiling, which only displays the latest statement. This archive offers a valuable historical record of tax payments and transactions for all legal entities, which is necessary for reference in cases of disputes, audits, or inquiries. By comparing current and past statements, discrepancies can be detected early, promoting adherence to tax obligations and ensuring compliance with regulatory requirements regarding the retention of financial records.

Industry-leading security

Konsise stands apart from other South African tax software platforms by offering an unparalleled level of security that sets the standard in the industry. The security of tax data is prioritised with a multi-layered security approach that boasts industry-leading certifications and compliance. Employing first-class security features, including encryption, firewalls, and robust access controls, Konsise provides maximum protection for your most sensitive tax data.

Accelerate routine company tasks

Security

Robust, industry-leading security

Enterprise-grade security

User authentication

Role-based access control

99% uptime

Get in touch for a FREE 45-day trial* today. No credit card required.

Use Konsise to streamline your regulatory teams, processes and data together in one place.

*Terms and conditions apply