Tax filing preparation, review & sign-off

Enhance overall tax filling accuracy and reduce errors

A single individual often assumes the tax preparation task, which poses various challenges, such as lack of oversight and the inherent risks in self-checking. Adopting a robust and secure approach to tax preparation, review, and sign-off is imperative. Konsise offers a comprehensive solution advocating the best practice of segregating duties by delegating distinct roles to various team members in the tax preparation process and streamlining the tax workflow by assigning responsibilities for preparation, review, and final sign-off to various team members. This ensures a thorough and meticulous examination of tax documents, reducing the likelihood of errors and enhancing the overall accuracy of tax filings. By leveraging Konsise, companies and accounting firms can facilitate collaboration and adhere to industry best practices in tax compliance. With Konsise, you can elevate your tax preparation standards, ensuring efficiency and increased security.

Built-in enterprise-grade security

World-leading security and compliance are built in, ensuring your company’s sensitive tax data remains protected.

Features for tax filing preparation, review & sign-off

Manage multiple jurisdictions

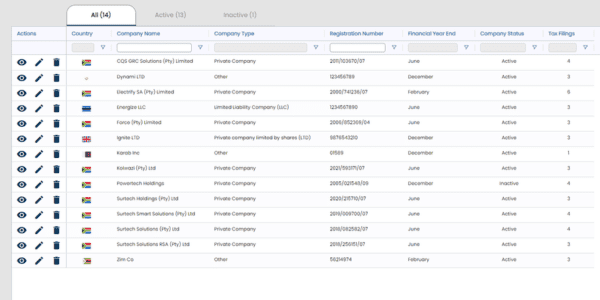

Konsise can proficiently manage tax obligations for companies operating across various jurisdictions. The platform is adept at handling diverse tax types across the globe without any restrictions on the nature or location of the company.

Unique tax types are a breeze

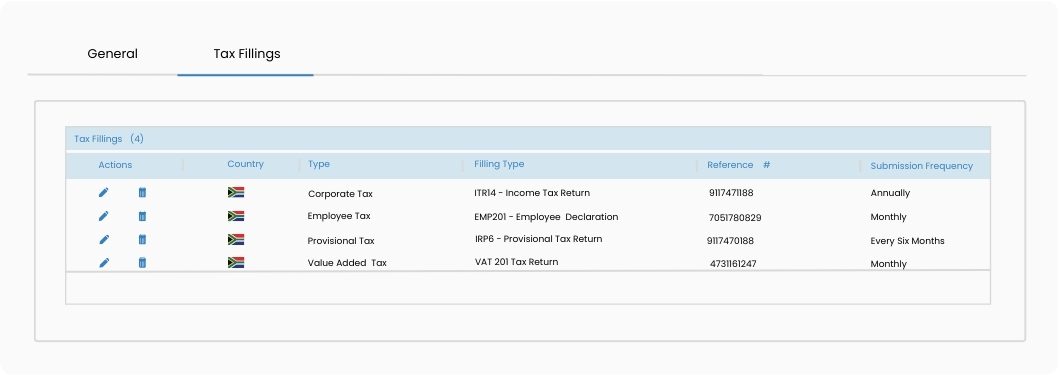

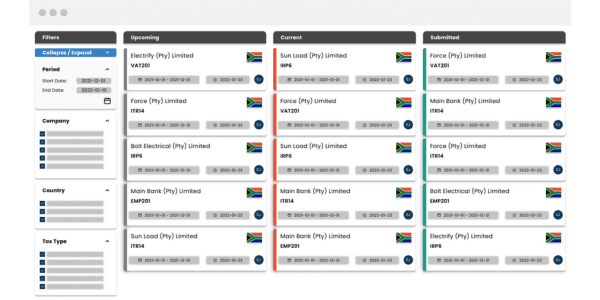

Konsise stores vital information about companies, individuals and trusts including their status, financial year-end, and tax filings for which they are registered. The system also allows users to add unique tax types and automatically generates reminders for submission and payment deadlines. The same functionality is available for trusts and individuals, with search boxes facilitating easy access to the desired information.

Immediate oversight of all tax filings

Once the software has identified all the entities required, such as companies, individuals and trusts, it can automatically create a “tax card” in Konsise, outlining the tax filing obligations. A tax card in Konsise is created for every tax filing obligation, whether the entity is a company, trust or individual, giving users an easy-to-consume overview of current and upcoming deadlines.

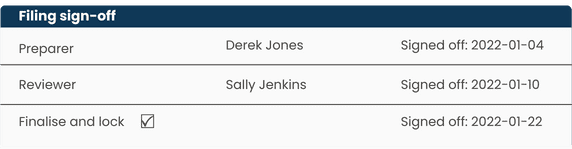

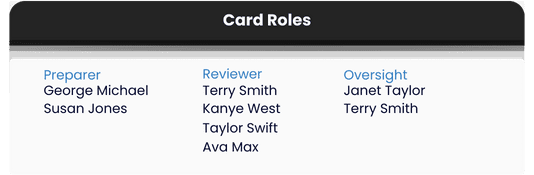

Customisable review & sign off workflow

The review and sign-off feature can be customised to enable designated users to oversee the progression of the review process and ensure compliance with established procedures. This feature represents a valuable tool for tax teams seeking to optimise their tax preparation and review process while preserving the accuracy and compliance of their tax returns.

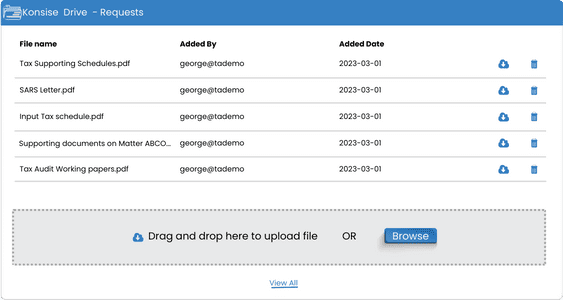

Encrypted documentation storage

Konsise Drive is a cloud-based location with full encryption, allowing users to store and manage relevant documentation, computations, reconciliations, and client communications in a secure environment. This platform lets users conveniently drag and drop any necessary files into the drive, ensuring a streamlined and efficient experience. With Konsise Drive, you can confidently store and manage crucial data while maintaining the highest level of security and privacy.

Minimise the risk of errors

Separation of duties is critical to effective internal control as it minimises the risk of erroneous and inappropriate actions. The built-in review and sign-off functionality allows tax teams and accounting firms to allocate specific users to prepare tax returns while assigning other users to review the same. The system can be configured with multiple review levels, specifying a sequence of reviewers and the number of times the review should occur. This ensures that the preparation and review processes are carried out diligently and accurately

Get a FREE 45-day trial* today. No credit card is required.

Use Konsise to streamline your regulatory teams, processes and data together in one place.

*Terms and conditions apply