Secure, easily accessible, tax record keeping

From darkness to discovery, a modern solution for storing tax records.

Maintaining a coherent and secure record-keeping system is pivotal. Traditional methods, whether they involve manual filing of hard copies or digital storage on platforms like SharePoint or File Explorer, often fall short. These systems lack contextualisation, making access cumbersome and time-consuming. Moreover, they pose significant security risks and the potential for lost or misplaced files. Establishing a cohesive and secure tax record-keeping system is essential. Traditional methods, whether manual filing or digital storage on platforms like SharePoint or File Explorer, often prove inadequate. These approaches lack context, resulting in cumbersome and time-consuming access, along with significant security risks and the potential for file loss. Introducing Konsise Drive, a groundbreaking solution designed for responsible tax professionals. This platform offers a secure, backed-up, and highly organised environment. Every stage, from preparation to review comments, is permanently secured and instantly accessible for the entire team to access. Konsise Drive streamlines compliance with legal record-keeping requirements, mitigating the risks of lost or deleted files. Embrace a seamless and secure method for effortlessly managing and accessing your tax records.

Built-in enterprise-grade security

World-leading security and compliance are built in, ensuring your company’s sensitive tax data remains protected.

Features for tax record keeping

Automated SARS payment & submission tracking

Trackers are populated automatically with data directly from SARS, allowing users to quickly filter information by country, entity type (individual, company or trust), tax category, and date range. Users can easily access a complete summary of each tax filing, including the preparer, reviewer, uploaded documents, and any related SARS correspondence with just one click. This information can be easily exported to Excel for a streamlined view of all returns.

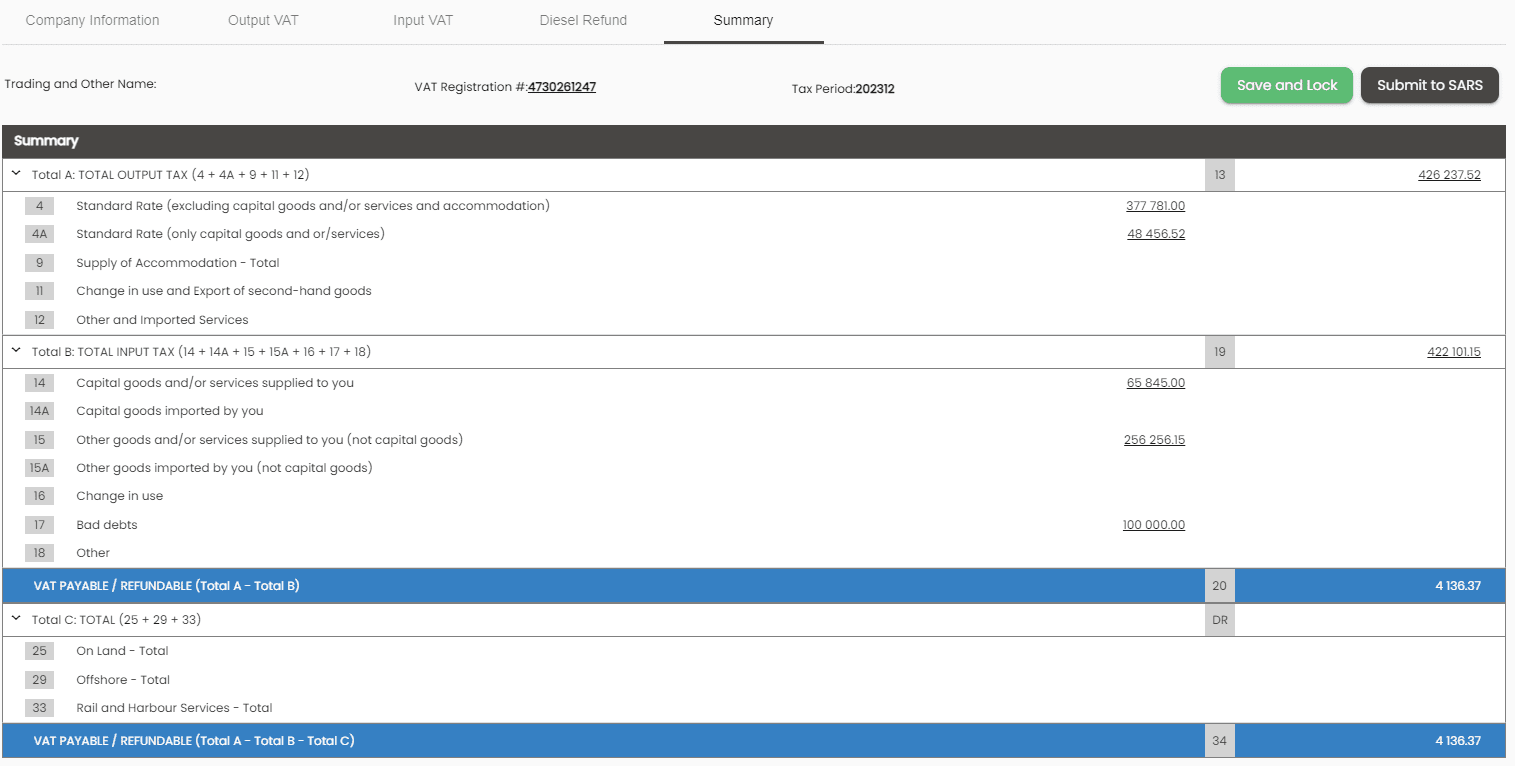

VAT Submission determination tab

Konsise offers an efficient solution for filing tax returns through its VAT submission determination tab. With this feature, users can easily determine output VAT and input VAT and generate a summary report to be submitted directly from the software.

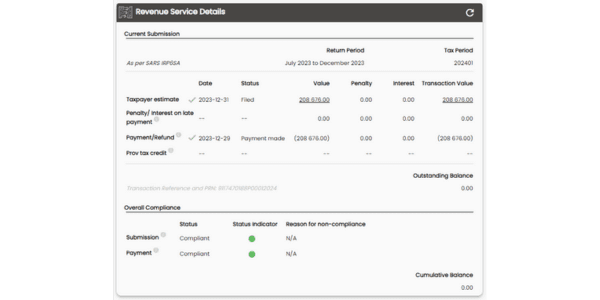

Download SARS Statement of Account

Konsise downloads the Statement of Account data from SARS for VAT, Employees Tax, Provisional Tax and Corporate Income Tax. This data populates the “Revenue Service Details” section on each tax return so that every submission and payment value is instantly visible within Konsise. Of course, this data aggregates to the Konsise reports which consolidate these values to measure compliance for each tax type and ultimately, each company.

Get a FREE 45-day trial* today. No credit card is required.

Use Konsise to streamline your regulatory teams, processes and data together in one place.

*Terms and conditions apply