In South Africa, Corporate Income Tax, also known as Company Tax, is imposed on the income earned by companies and other legal entities such as close corporations and co-operatives. The corporate income tax is calculated based on the company’s net income, which is the company’s total revenue minus any allowable expenses or deductions.

In this blog post, we will be discussing how businesses can automate an overview of their Corporate Income Tax assessment with Konsise’s Corporate Income Tax report . This report allows businesses to easily access, analyse, and report on their Corporate Income Tax information, simplifying the tax management process and improving efficiency and compliance. We will delve into the specifics of how this report works, and the benefits it can bring to your business.

What is a Corporate Income Tax assessment?

A Corporate Income Tax assessment is the process of determining the amount of corporate income tax that a company or other legal entity is liable to pay. This process typically involves several steps, including:

- Gathering and reviewing financial data: Tax professionals must gather and review financial data such as income statements, balance sheets, and cash flow statements to determine a company’s net income and tax liability.

- Identifying tax deductions and credits: Tax professionals must identify and claim any tax deductions and credits that a company is eligible for to minimise the company’s tax liability.

- Preparing and filing tax returns: Tax professionals must prepare and file the company’s corporate income tax return with the relevant tax authorities. This may involve calculating the company’s tax liability, completing tax forms, and providing documentation to support the company’s tax return.

- Compliance and reporting: Tax professionals must ensure that the company is in compliance with all relevant tax laws and regulations and that the company’s tax returns are accurate and complete.

- Tax planning: Tax professionals must be able to analyze the company’s financial statements and operations to identify tax planning opportunities. This could be related to tax efficiency, compliance or tax saving strategies.

- Representation: Tax professionals may have to represent the company in front of tax authorities, attending tax audits, and negotiating with tax authorities.

- Staying up-to-date with tax laws and regulations: Tax professionals must stay up-to-date with changes in tax laws and regulations to ensure that the company is in compliance and to identify any new tax planning opportunities.

The Corporate Income Tax Report in Konsise

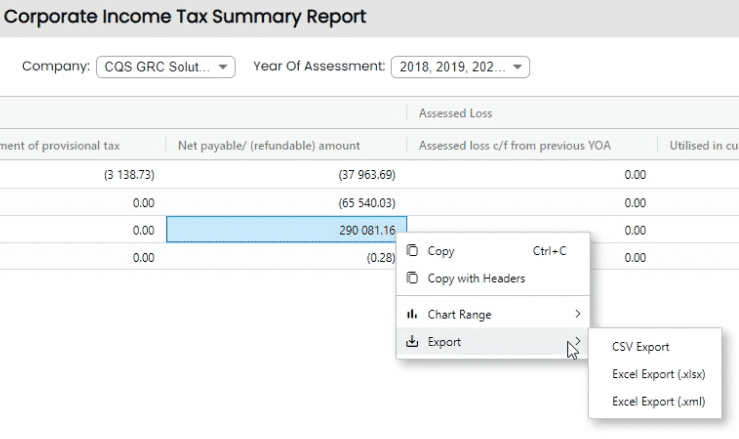

The Corporate Income Tax report in Konsise is a tool that allows users to view and manage summary information from the ITA34C notice of assessment for all of the legal entities in a single report. This includes any provisional payments or overpayments, as the case may be, or any interest applied by SARS. The Corporate Income Tax report includes information related to the assessed losses, including any balance brought forward from prior year of assessment, balance utilised in the current year, and the balance carried over to the next year of assessment.

The report can be filtered either by company or year of assessment to find the exact information required. And as with all the reports in Konsise, a simple right click and you can export the data to Excel.

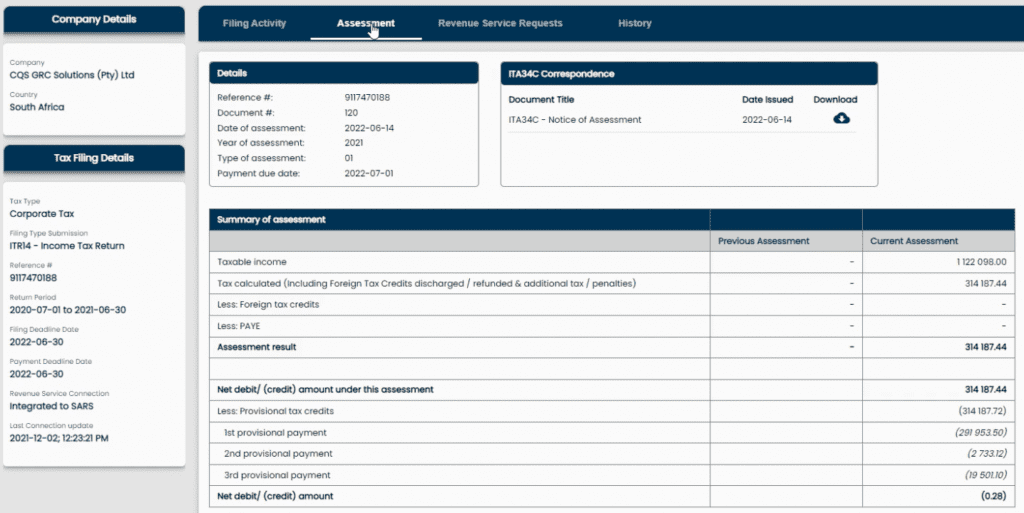

The report is made possible through Konsise’s link into SARS. Konsise automatically picks up the ITA34C notice of assessment from SARS and pulls the relevant data across to the assessment tab on the Corporate Income Tax card and simultaneously attaches the correspondence itself to the card as well.

In the event of a reassessment, both values are visible, including any provisional payments already made. This report is going to be a huge time saver for those who are currently tracking this information manually in Excel.

What are the benefits of using the Corporate Income Tax report in Konsise?

Konsise’s Corporate Income Tax report saves time and improves accuracy by automating the process of gathering and reviewing corporate income tax information. The report is able to pull the relevant data from the ITA34C notice of assessment automatically by linking into SARS. This eliminates the need for tax professionals to manually track and review the information in Excel, which can be a time-consuming and error-prone process.

This automation not only saves time, but also improves the accuracy of the Corporate Income Tax assessment process. By eliminating the potential for errors that can occur during manual data entry and review, the report helps ensure compliance with tax laws and regulations, while also reducing the risk of penalties and fines.

Checkout some other features provided by Konsise Tax Software.

Conclusion

In summary, Konsise’s Corporate Income Tax report is a game-changer for businesses looking to streamline and automate their tax management process. With its automatic integration into SARS, the report eliminates the need for manual data entry and tracking in Excel, saving businesses valuable time and resources.