Running a business in South Africa is a challenge at the best of times but SARS deadlines can seriously have you pulling your hair out. The South African Revenue Service (SARS) has become increasingly more stringent with their rules and procedures, so the smallest mistake can really cost you in terms of penalties and wasted time. But thanks to technology, the days of manual tax compliance are long gone. Tax software in South Africa makes tax management and tax compliance for businesses much easier and stress-free.

With that being said, not all tax software is created equally. The first challenge to finding a suitable tax software in South Africa is trying to find tax management software that actually supports the South African tax system. There are a lot of tax software providers designed for the US, Canadian and European markets that are not relevant or useful to South African businesses. This leaves fewer options locally.

Another challenge is that the majority of available tax management systems form part of a larger financial management software or ERP platform and are not standalone products, so lack some critical features those large corporates in South Africa in particular would need in order to remain SARS compliant. In fact, finding any standalone tax management solution in South Africa is a challenge in and of itself.

Make Corporate Tax Less Taxing With The Best Tax Software in South Africa

To help you find the best tax management software for your business, we’ve compiled a list of 5 of the best tax management software and tax compliance software that are currently available to the South African corporate market.

Konsise

Konsise certainly lives up to its name because it is by far the most comprehensive tax management software available to date. It provides an all-in-one “concise” solution for managing and automating your company tax workflow including PAYE, VAT and Corporate Tax. Often you will need to use multiple tools and platforms to be tax compliant in the eyes of SARS and end up wasting hours every month doing things manually. Konsise replaces many of the other applications that finance professionals have had to improvise with in one convenient place.

Features

- Enables direct submissions to SARS of company specific filings such as VAT201 & IRP6

- Automatically tracks deadlines and alerts you closer to the time

- Team reviews and sign-offs for best practice when preparing submissions

- General ledger recons

- Excellent security features to prevent unauthorised user access

- Record keeping for permanent secure access to all files

- Correspondence from SARS sent to the whole team, so it never goes unseen

- Uploading and logical filing structure for documentation pertaining to tax submissions or SARS tax audits to easy tracking of historic tax returns

Pros

- Free 45-day trial

- All-in-one tax management system

- Affordable, transparent pricing plans

- Fully tax compliant and up to date with SARS requirements

- Excellent customer service

- SARS Statement of Account integration for a quick overview of your SARS account balance

- Designed specifically for in-house finance teams

- Sleek and user-friendly interface

- Integrated to SARS for retrieval of correspondence and SOA values for VAT201, IRP6 & ITR14 and can submit directly for VAT201 & IRP6.

Cons

- Not an accounting software platform so cannot send and manage invoices. Konsise is specifically geared towards improved tax management and greater tax compliance.

Bottom Line

A tax management system that really can do it all to make tax compliance stress-free and super-efficient for companies with multiple legal entities, even in different jurisdictions.

GreatSoft

GreatSoft is cloud-based tax software in South Africa that enables tax compliance through the submission of Companies Tax Returns, Individual Tax Returns, Provisional Tax Returns and Trust Tax Returns through their GreatSoft Tax Suite. This tax management software has been developed specifically for tax practitioners so there is a greater emphasis on being able to submit different types of tax returns

Features

- Direct integration with SARS eFiling (for some tax types)

- Peer approvals

- Automated alerts close to deadlines

- Built-in check and validations to ensure all submissions are complete

- Automatic updates of SARS correspondence or submissions of returns ready for submission

- Built-in client billing for tax professionals

Pros

- Can submit Individual, Provisional and Trust tax returns in addition to Corporate tax returns

- Statement of Account dashboard for a quick overview of your SARS account balance

- User-friendly interface

Cons

- GreatSoft’s target market is geared more towards tax practitioners than businesses, so finance teams may find some of the functionality irrelevant.

- For businesses looking for all-in-one tax management software, this is probably not the way to go

- No pricing on website so have to contact them and wait for price options

Bottom Line

A feature-rich and well-developed software with a sleek user-interface, however more geared towards a tax practitioner than a business.

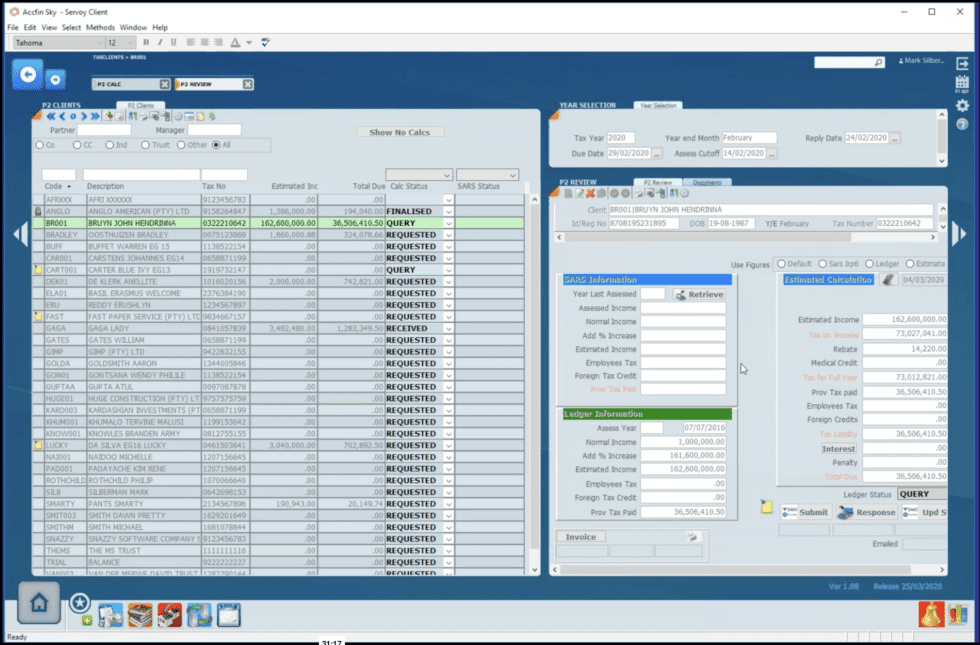

Accfin

Accfin offers a software package called Sky Tax, an automated tax management platform built for tax practitioners or company tax departments in South Africa. Sky Tax allows you to manage and track your company’s tax obligations and ensure you do not miss tax submission deadlines. The system mimics the general tax workflow to automate manual, repetitive tasks.

Features

- Direct integration with SARS for automatic retrieval of tax information related to ITR12, ITR12 Trusts and ITR14.

- Built-in tax calculator that automatically calculates and submits the tax return to SARS

- History of previous tax returns

- General Ledger recon

- Automatic invoicing to tax clients

Pros

- Helps accounting practices and tax practitioners convert to paperless tax management

- Assists tax professionals in automating menial and repetitive tasks

Cons

- Geared towards tax professionals, so Sky Tax is missing some features in-house finance teams would appreciate and expect such as peer reviews and deadline alerts

- Basic user interface, lacking some essential features for corporates

- No free trial

Bottom Line

Provides some useful features but lacks some of the features a business needs to properly manage the complexities and volume of corporate tax.

Sage

Sage is a very well-known accounting software used by both small, medium and large firms. They offer a number of different products depending on the business’s needs and size. Sage allows businesses to manage everything from their expenses, invoices and payroll to tax compliance. However, this is not a tax management software and is only a very small aspect of what Sage offers. Their core focus is on providing business management and accounting software, so the tax management features offered by their software such as SageIntacct or SageEvolution200, while helpful, are not as robust as some other tax software in South Africa.

Features

- SageIntacct allows you to monitor and manage sales tax and PAYE

- Sage Business Cloud Accounting Edition now offers automated VAT201 eFiling submissions to SARS (this feature is for accountants only)

- Ability to add VAT to invoices

- Manage payroll and employee PAYE

Pros

- One of the very best business management software options available to small, medium and large businesses

- Can keep track of VAT and PAYE for improved tax compliance

Cons

- VAT eFiling is only available on the Sage Business Cloud Accounting Edition so it must be done manually

- Sage offers more of an accounting, payroll and business management solution as opposed to tax management software, so it is missing some important features for this purpose

Bottom Line

A well-known and trusted name in finance but this is more of an accounting system and its tax management and tax compliance features won’t cut it for large businesses with complicated tax affairs.

ONESOURCE

ONESOURCE is a Corporate Tax software developed by Reuters, so you know this will be a quality product. ONESOURCE helps businesses submit tax returns timeously and accurately with their robust tax management software. This solution can equip your tax department to calculate and submit tax returns with confidence.

Features

- Submit ITR14 tax returns directly to SARS via ONESOURCE

- Tab view of tax schedules for a clear overview

- Accurate tax information and calculations

- Up to date with current ITR14 disclosure requirements

- A warning system when balances are not in line with the general ledger

- Storage of supporting information

Pros

- The local version of this product has been developed with the help of South African tax experts to create a comprehensive and compliant tax management system for the South African market

- Excellent security features to prevent unauthorised user access

- Great local customer support including training, customisations and on-site support

- Compatible with most major accounting systems

Cons

- No pricing information immediately available and pricing is in USD, making this is a costly software after the Dollar to Rand conversion

- Software can be slow to load which can be very frustrating

Bottom Line

ONESOURCE offers some excellent features and comes close to ticking all the boxes but because it is a global product, it can be slow to load and there is less of a personalized touch to customer support.

What To Look For When Selecting a Tax Management Software

SARS have clamped down on businesses in recent years so tax compliance for businesses has become a lot more complex. The bigger the business, the more complex the tax affairs can get. That is why when selecting a tax management software, you need to select a product that is robust, up to date with SARS requirements and simplifies the tax workflow as much as possible and offers local support.

The most important features you should look out for are the following:

Cloud Based Tax Management: Having your tax software on a cloud-based server eliminates the need for additional hard disk space and other issues when the software must be installed on machines. Cloud-based software is also much more secure and less vulnerable to security breaches. In addition to this, cloud-based tax management software aligns well with the move towards work-from-home and hybrid work arrangements.

Covers All Necessary Tax Obligations: Businesses have multiple tax obligations such as PAYE, VAT, Carbon Tax, Diesel Tax and so forth. Each of these have their own submission and payment deadlines. Your tax software should be able to automatically keep track of these and fulfil them to keep your business tax compliant.

Automated Deadline Tracker: With so many tax obligations and deadlines to keep track of, your tax software should have a deadline tracker, so you are alerted well in advance when it is time to prepare and submit your tax returns.

Direct integration with SARS: It makes sense that your tax software integrates directly with SARS. This way you have a dashboard that updates in real time to give you an overview of your statement of accounts and all correspondence from SARS.

Attachments: Your tax software should allow you to upload relevant documents to support your tax submissions including the general ledger recon and spreadsheet with all recorded expenses.

There are a couple of other features and functions a comprehensive tax management software should have which we covered in detail here.

Final Thoughts

When you really look at it, there are so few fully comprehensive tax management systems available to South African businesses. And with corporate tax being as complex as it is, you need a system that does it all to ensure you remain tax compliant. As we have seen in recent years, there are huge repercussions for businesses who fail to uphold their tax obligations.

It’s rare you will find tax software that ticks all the boxes. Most accounting software has tack-on features that can help your business manage its taxes to an extent, but most lack the necessary features to manage your taxes with confidence. Konsise, however, does just that. Konsise has been developed primarily for the South African market by South Africans, taking into account all the shortcomings of existing tax management and tax compliance software packages, to create a product that truly does it all. If you are ready to take your business tax management digital and transform the way your business manages its tax affairs, get in touch with our friendly sales team to run through what Konsise can do for you.

This blog article was complied based on publicly available information on the linked websites on 3rd of January 2023 and any additional edits on those pages or product updates have not been taken into account.