Automated tax management software. Tax workflow for finance & tax teams

Tax management software gives finance & tax teams in South Africa a single platform to manage their SARS tax filings such as VAT, PAYE and Corporate Tax.

Get a free demo with no obligation

Alternatively download our ebook

You may not have heard of us but these South African industry leaders have

Top 5 tools that were not designed for tax management or tax compliance

Why commonplace tools should not be used for tax management

SARS eFiling

- QIntermittent downtime

- QNo team collaboration

- QOutdated interface

Spreadsheets

- QTime consuming manual processes

- QNo version control

- QNo review and sign off

Outlook

- QIneffective communication

- QNo audit trail

- QNo team collaboration

Calendar

- QManual tax deadline monitoring

- QNot configurable for different tax types

- QNo reminder emails

Sharepoint

- QRange of features create an instructed file mess

- QNot secure, easy to edit or delete

- QComplex to maintain

Countless hours lost each month to manual time consuming processes instead of higher value strategic tasks

Level up your tax management in 3 easy steps

End-to-end tax software that brings your tasks, team members and tools together for better tax management.

- RDirect submissions to SARS

- RAutomated deadline tracker

- RContextual file management

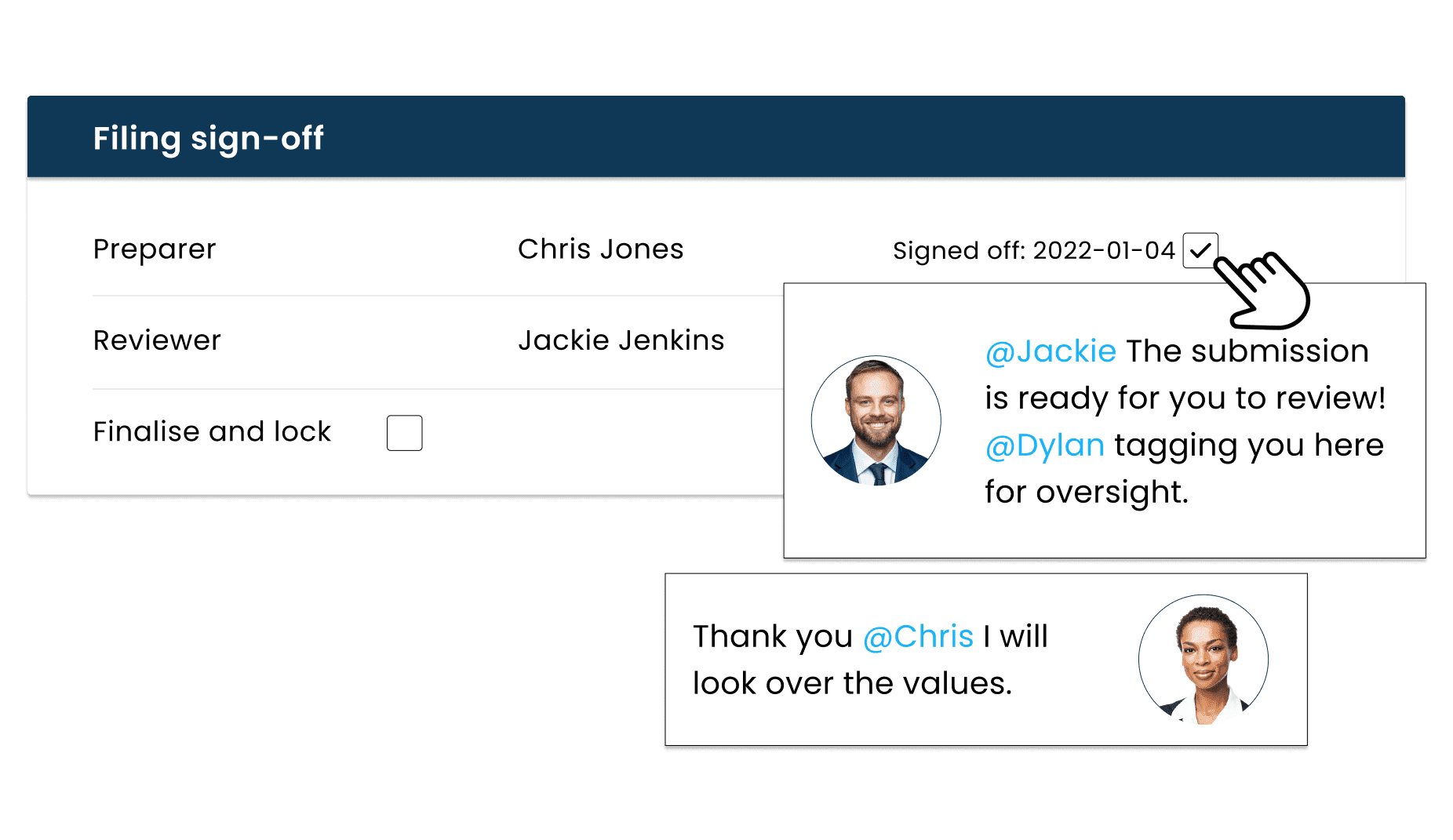

- RTeam review & sign-off

- RRecord keeping

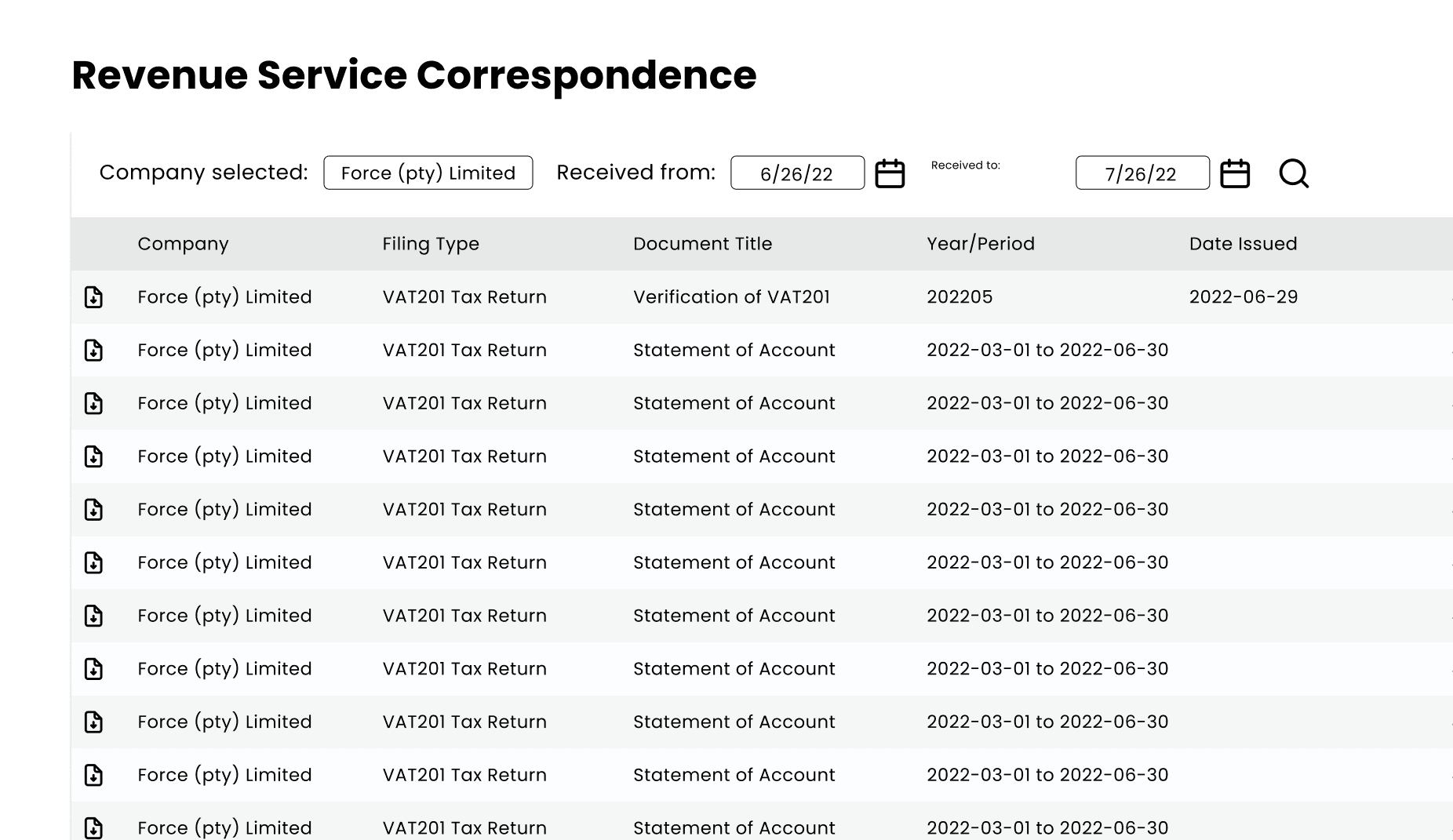

- RTeam access to SARS correspondence

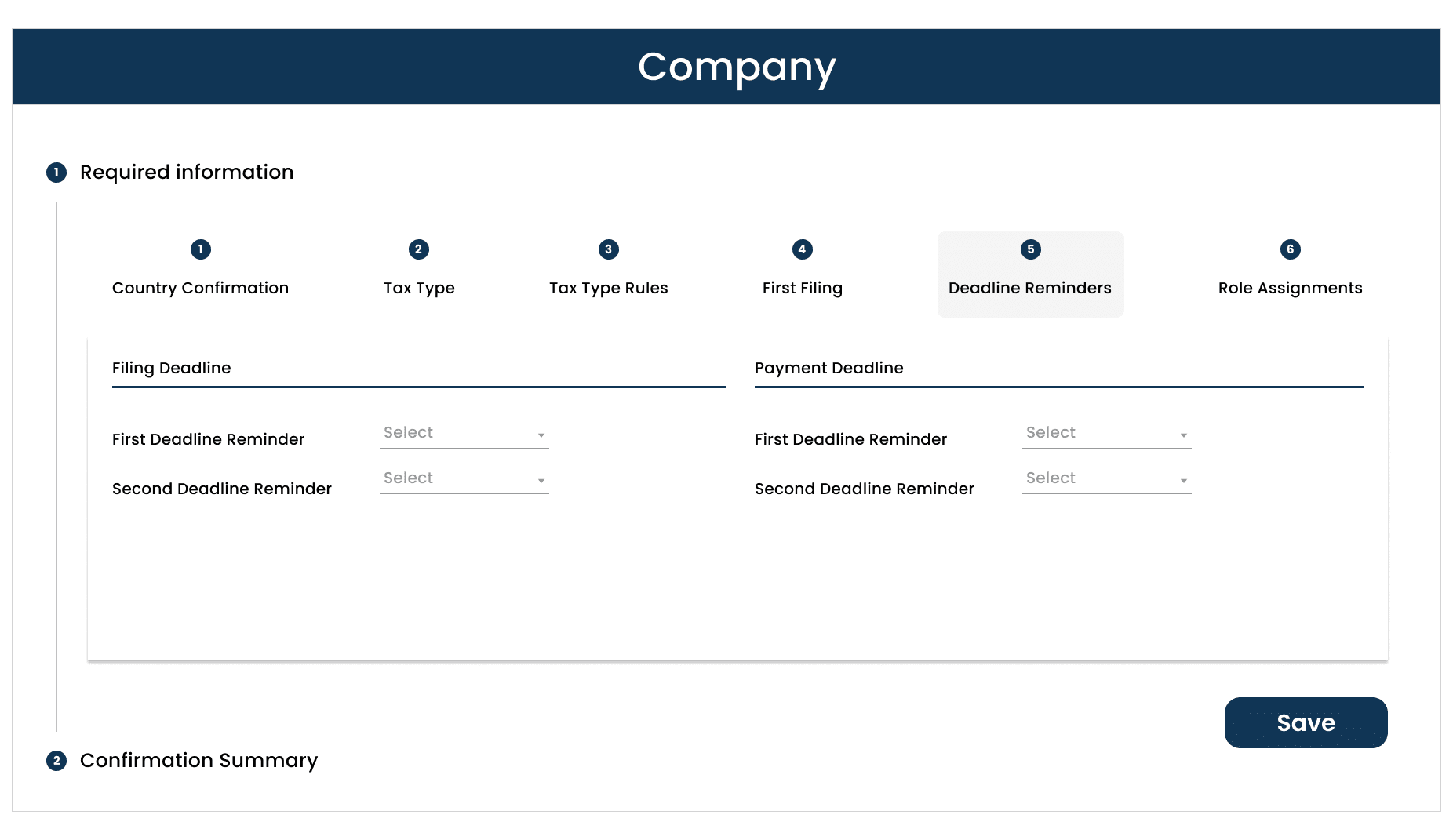

Automated tax workflows

Intuitive tax workflow management

Manage team tasks, authorisations and approvals as well as filing deadlines and tax compliance status for all legal entities with intuitive workflows.

Enhanced team collaboration

Team workflow simplified

Transform the way you see and manage tax work with collaborative tax management software. A simple platform that is powerful enough to handle the full company tax process from preparation to submission, and beyond.

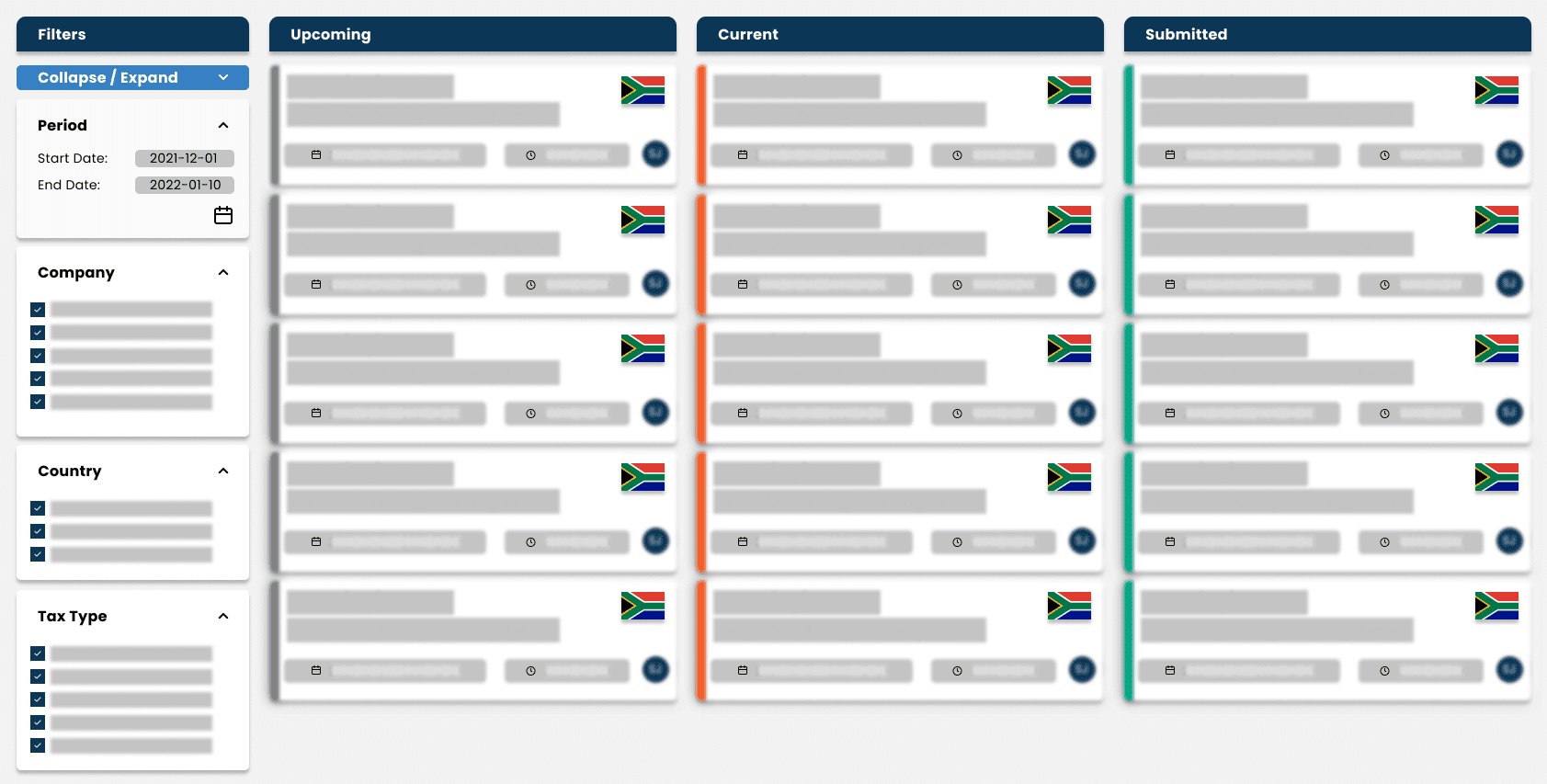

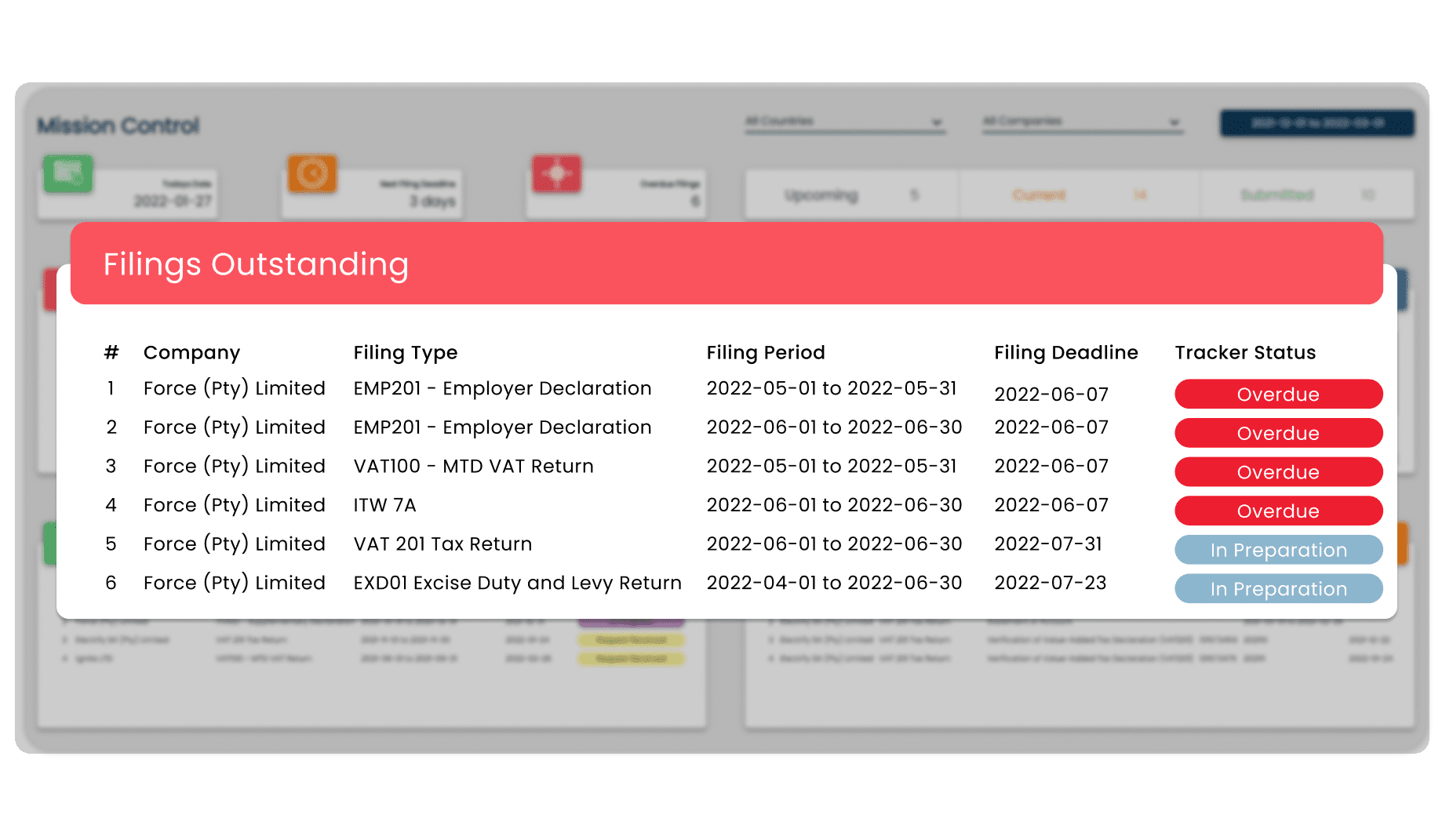

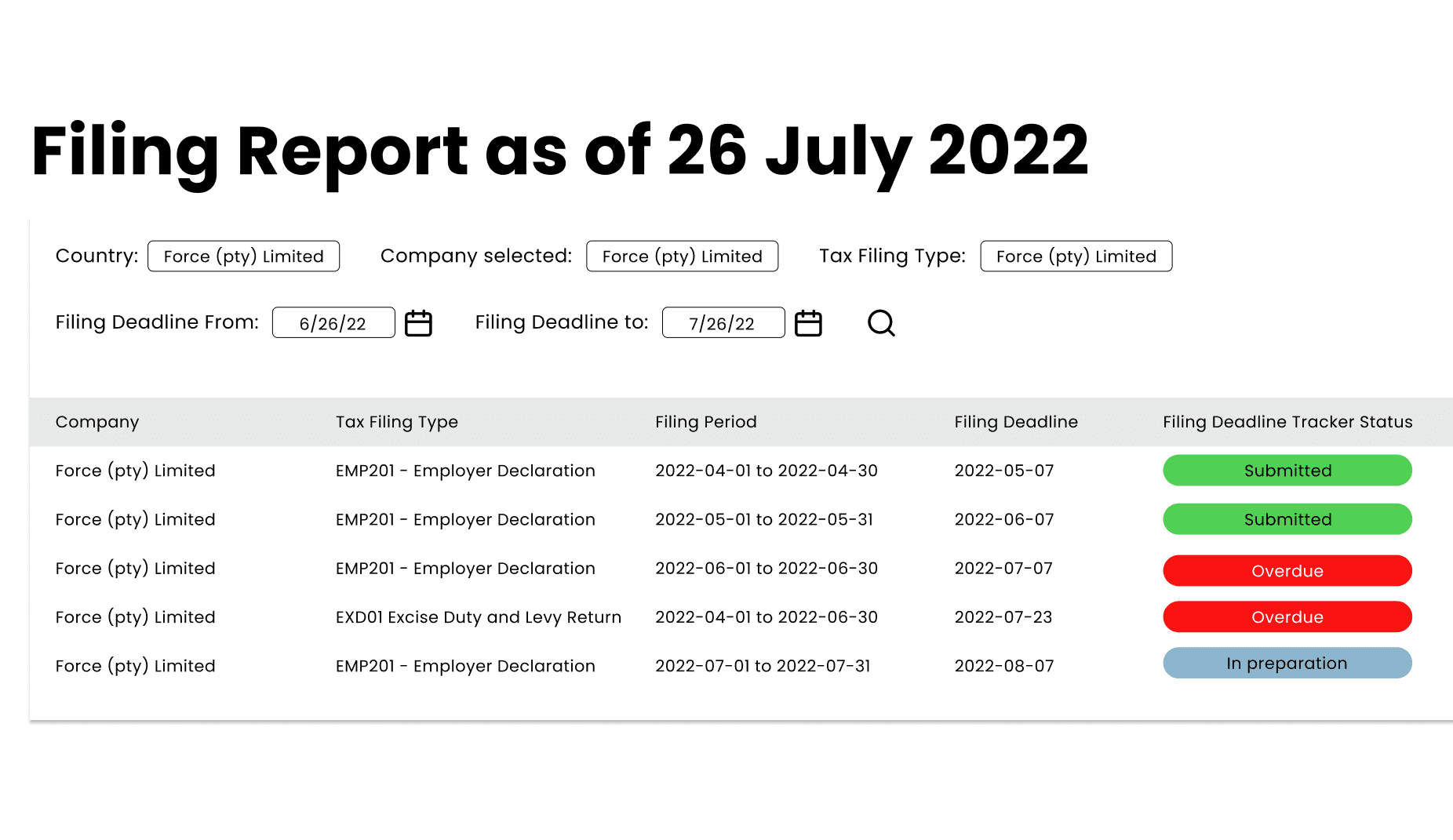

Automated Deadlines

Deadline & task tracking

With automated tax due date tracking and task management never miss a filing deadline and create a smother running team. No matter how many returns always be on top of the deadlines and workload.

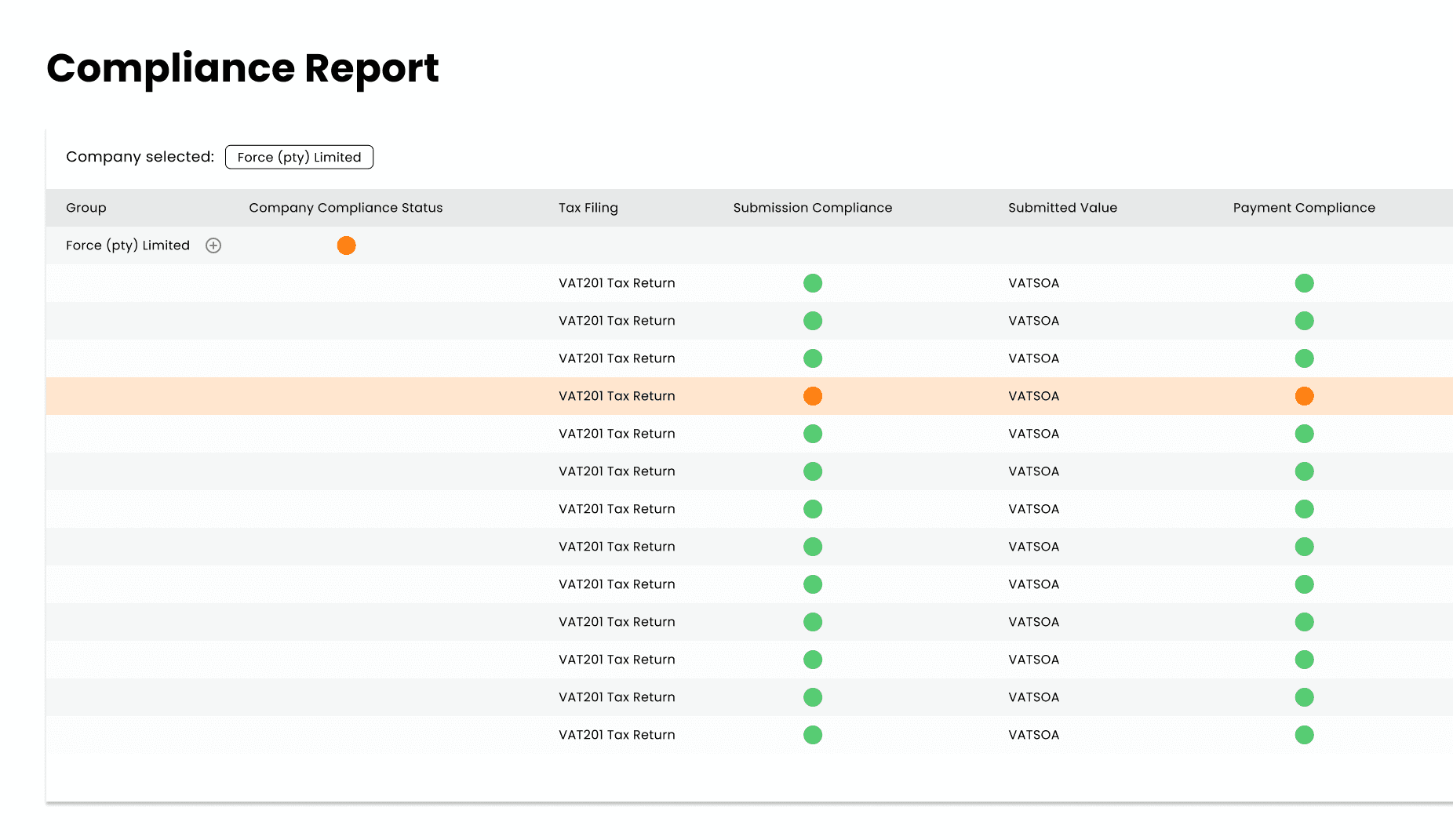

Improved tax compliance

Verify tax compliance status

View current compliance status against specific SARS requirements and stay SARS tax compliant. Tax compliance contributes to the positive growth of the South African economy which benefits all South Africans.

Team oversight

Have oversight of all tax filings at a glance

Collaboration empowers team to hit their shared goals. With real-time insights into team work, reduce duplicate effort and increase visibility to see who’s working on what. Keep the team and tasks connected to spot trouble before it costs you.

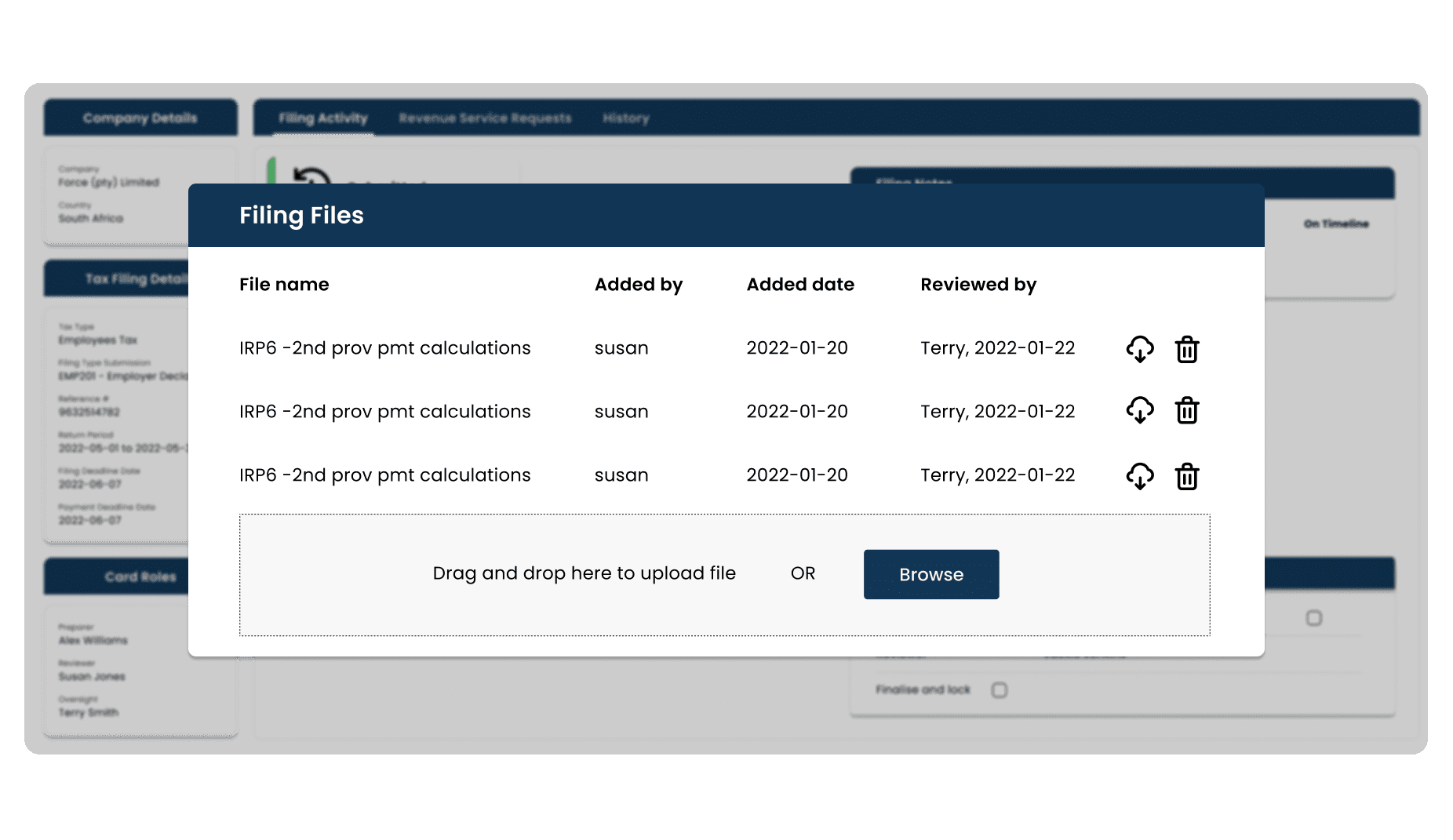

Tax filing records

Organised tax paperwork

Work and share documents in real time. Well organised digital documents that are accurate, complete, and readable can save significant time without the need for huge filing cabinets in the basement.

File attachments

Secure file attachments for relevant tax documentation

Attach relevant tax documentation to filings for review and record keeping. Contextual filing for future ease of access in the case of an audit or verification.

Tax charts and graphs

Automated tax reporting and oversight

Visualise data to troubleshoot problems and bottlenecks. Get actionable insights to keep work on track and take action as it is needed.

Get a no obligation demo and level up with tax managment software today

Giving finance & tax teams in South Africa a single platform to manage their SARS tax filings such as VAT, PAYE and Corporate Tax.

Alternatively download our ebook