Introduction

In today’s fast-paced business world, productivity is key. As a business owner or manager, finding ways to streamline processes and improve efficiency can make a huge impact on your bottom line. One area where businesses often struggle with productivity is tax compliance. Managing tax obligations can be time-consuming and complex, especially for businesses with multiple entities or operating in multiple jurisdictions. That’s where Konsise’s review and sign off functionality comes in. This powerful feature helps businesses to efficiently manage their tax compliance processes, saving time and reducing the risk of errors or missed deadlines. In this blog, we’ll delve into the benefits of Konsise’s review and sign off functionality and how it can help your business to maximise productivity.

What is the review and sign off function in Konsise?

Konsise’s review and sign off functionality is a powerful tool that helps businesses streamline their tax compliance processes and improve productivity. This feature allows multiple users to collaborate and review tax submissions, ensuring that all necessary information is included and that submissions are accurate and timely. With the review and sign off function, businesses can reduce the risk of errors, improve communication and coordination among team members, and ensure that all tax obligations are met in a timely and efficient manner. Whether you are an accounting firm or a large enterprise, Konsise’s review and sign off functionality can help you streamline your tax compliance processes and improve productivity.

The review and sign off functionality in Konsise streamlines the tax return preparation and review process by providing a centralised platform for reviewing and approving tax returns. Rather than having to track down physical copies of documents or review them individually on separate systems, the review and sign off functionality allows multiple reviewers to access and comment on the same document and returns simultaneously. This ensures that all comments and suggestions are recorded in one place. Additionally, the functionality includes built-in approval workflow capabilities, allowing reviewers to easily track the progress of returns through the review process and ensure that they are finalised and submitted on time.

How does multiple levels of review work?

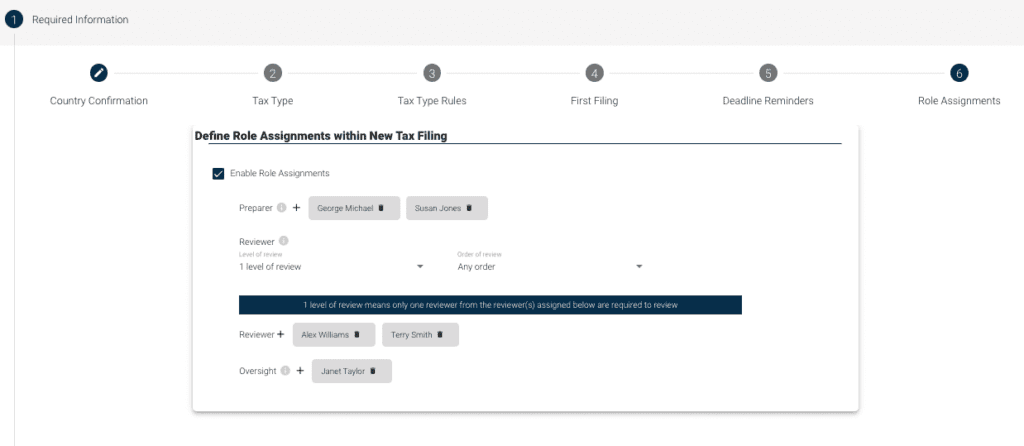

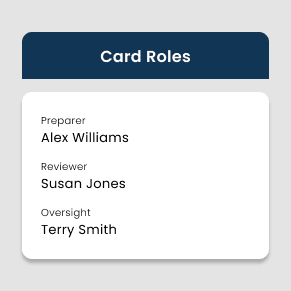

This review function allows for multiple levels of review within the tax return process. This means that different team members or individuals can review and sign off on the tax return before it is finalised and submitted.

Tax teams can assign specific users to prepare tax returns (Preparers) and other users to review the preparation (Reviewers). This helps to ensure that tax returns are accurate and compliant before they are filed. Additionally, the review and sign off feature can be set up with multiple levels of review, where a specific sequence of reviewers can be defined and the number of times the review needs to happen can be specified. For example, a tax team may want to set up to require two reviewers to review a tax return before it is filed, or they may want to require only one reviewer to review the return but allow for the option of a second review if needed. The feature can also be configured with an oversight role, allowing certain users to view the progress of the review process and ensure that it is being completed correctly.

The importance of a sign off function

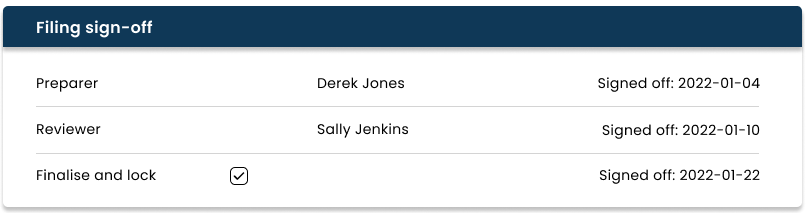

The sign off function is an important aspect of the review and sign off feature in Konsise’s tax compliance software. It allows reviewers to lock off documents and tax returns once they have been reviewed and deemed accurate and compliant. This ensures that the documents and returns cannot be altered or tampered with after the review process is complete.

There are several benefits to this function. First and foremost, it helps to ensure the integrity and accuracy of the tax returns and documents that are filed. By locking them off after review, it minimizes the risk of errors or omissions being introduced after the review process is complete.

In addition, the sign off function helps to streamline the tax preparation and review process. By locking off documents and returns after they have been reviewed, it prevents the need for multiple reviewers to go over the same documents multiple times. This can save time and improve productivity within the tax team.

Audit history in a tax workflow

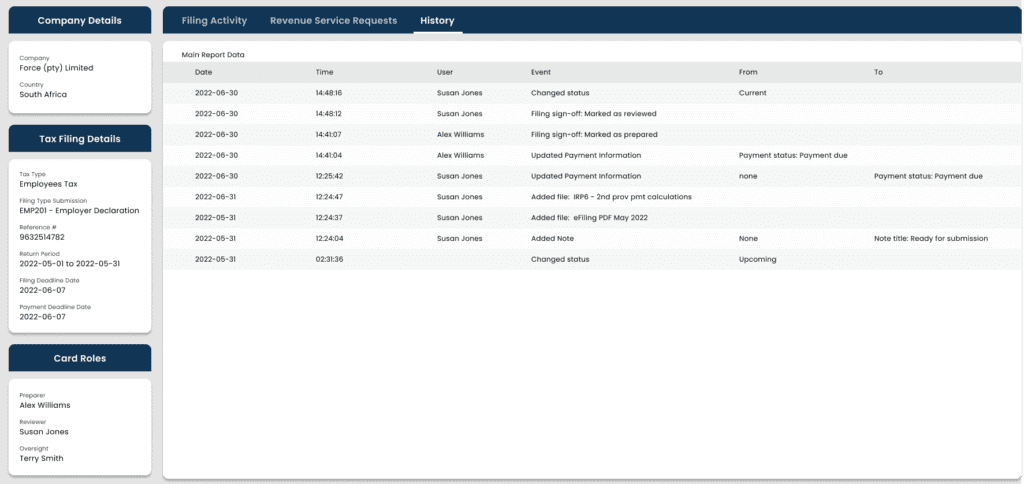

The audit history function within Konsise’s serves as a record of all actions taken on a specific tax return filing card. This includes any changes made to numbers on the tax form, document uploads, preparation, review, and sign off by specific users, as well as the date and time of each action.

Having this comprehensive record of activity on a tax return filing card is especially useful in the event of an audit or verification, as it provides a clear record of the steps taken to prepare and file the tax return. It can also help to identify any potential issues or errors that may have occurred during the tax preparation process.

In addition to its usefulness during audits and verifications, the Audit History function can also benefit tax teams by providing increased transparency and accountability within the team. It allows team members to see who was responsible for specific actions and when they were taken, which can help to identify any potential bottlenecks or inefficiencies in the tax preparation process.

Conclusion

In conclusion, Konsise’s review and sign off functionality is a powerful tool that helps businesses streamline their tax compliance processes and improve productivity. With features like multiple levels of review, an oversight role, and a sign off function, Konsise helps businesses to ensure that their tax returns and documents are accurate, compliant, and filed on time. By streamlining the tax preparation and review process, businesses can save time, reduce the risk of errors, and improve communication and coordination among team members. Whether you are an accounting firm or a large enterprise, Konsise’s review and sign off functionality can help you maximise productivity and streamline your tax compliance processes.